These are the 3 Best Cryptocurrency ETFs to buy in April 2024, as per Wall Street analysts. Exchange Traded Funds (ETFs) are investment vehicles that form a pool of companies from a specific sector, asset class, commodity, currency, or investment strategy. Investors who shy away from the complications of investing directly in cryptocurrencies or crypto stocks can consider investing in crypto ETFs.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Bitcoin (BTC-USD) halving event, which occurred on April 19, 2024, essentially cut a Bitcoin miner’s block reward by half. Following the recent halving event, the reward fell to 3.125 BTC per mined block from 6.25 BTC per mined block. The Bitcoin halving event is set into the crypto ecosystem to reduce inflation and the supply of Bitcoins.

The event is usually followed by a spike in Bitcoin prices. However, this year’s event did not spark as much enthusiasm, as the approvals of Spot Bitcoin ETFs balanced the demand/supply of bitcoins. Since the recent halving event, BTC prices have gained roughly 4.6%. Let us look at the three best blockchain ETFs to buy in April, with solid upside potential in the next twelve months.

#1 VanEck Digital Transformation ETF (NASDAQ:DAPP)

The VanEck Digital Transformation ETF tracks the MVIS Global Digital Assets Equity Index, a market-cap-weighted index that is focused on a pool of global companies involved in the digital asset economy. DAPP’s investment strategy is based on the fact that these companies are forerunners in the crypto world and have the potential to generate at least 50% of revenue from digital assets. DAPP includes crypto exchanges, miners, and blockchain infrastructure companies.

Launched in March 2021, DAPP’s NAV (net asset value) has lost roughly 29.2% since its inception. However, in the past year, DAPP has gained 149.5%. The equity-focused ETF holds 22 investments as of date, with a total value of $109.48 million. Its top five major holdings include TeraWulf Inc (WULF), Block (SQ), Coinbase Global (COIN), MicroStrategy (MSTR), and CleanSpark (CLSK) and constitute roughly 37.71% of the total portfolio.

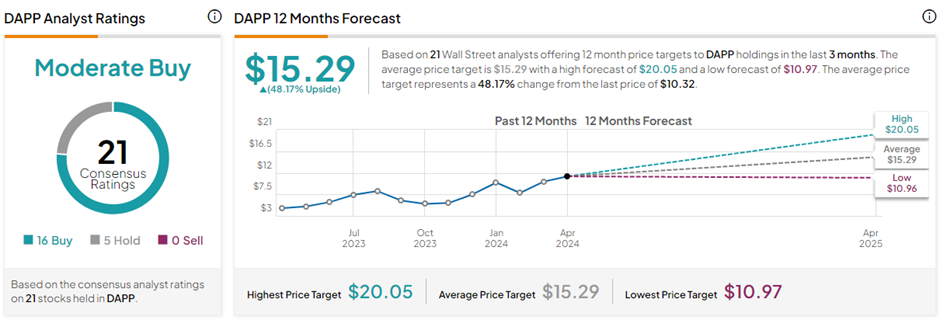

Is DAPP ETF a Good Investment?

On TipRanks, DAPP has a Moderate Buy consensus rating based on 16 Buys versus five Hold recommendations. The average VanEck Digital Transformation ETF price target of $15.29 implies a massive 48.2% upside potential from current levels.

#2 Fidelity Crypto Industry and Digital Payments ETF (NASDAQ:FDIG)

The FDIG is a passively managed fund that tracks the performance of the Fidelity Crypto Industry and Digital Payments Index, which in turn invests in companies engaged in activities associated with cryptocurrency, related blockchain technology, and digital payments processing.

FDIG was launched in April 2022, having gained only 7.5% in the life of the ETF. Having said that, FDIG has jumped 88% in the past year, thanks to the surging cryptocurrency prices. As of March 31, 2024, FDIG had 39 holdings, with an asset value of $102.11 million. FDIG’s top 5 holdings are Coinbase Global, CleanSpark, Marathon Digital, Riot Platforms, and Cipher Mining (CIFR). These top holdings compose 44.7% of the portfolio.

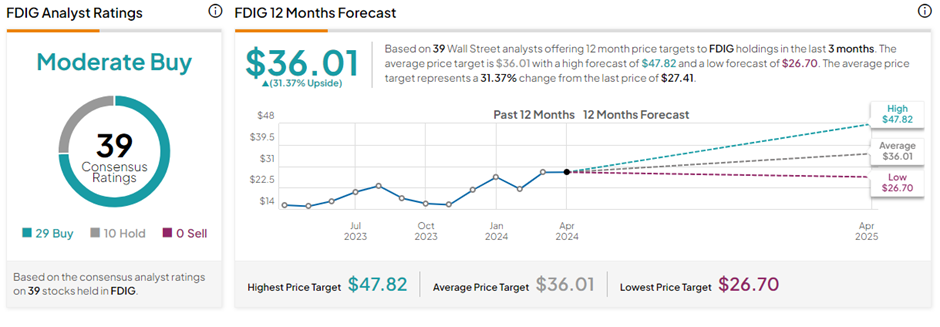

Is FDIG a Buy, Sell, or Hold?

With 29 Buys versus 10 Hold ratings, FDIG has a Moderate Buy consensus rating on TipRanks. The average Fidelity Crypto Industry and Digital Payments ETF price target of $36.01 implies 31.4% upside potential from current levels.

#3 First Trust SkyBridge Crypto Industry and Digital Economy ETF (NYSEARCA:CRPT)

CRPT is an actively managed ETF that seeks to provide capital appreciation. The fund’s investment thesis is to invest at least 80% of its net assets in common stocks and ADRs (American Depositary Receipts) of companies associated with the crypto industry and digital economy.

CRPT was launched in September 2021. As of March 28, 2024, CRPT has lost 10.4% since its inception but gained 184.2% in the past year. The equity-focused ETF has 32 holdings as of date, with a total value of $52.28 million. Its top 5 holdings include Coinbase Global, MicroStrategy, Galaxy Digital Holdings (TSE:GLXY), Riot Platforms (RIOT), and Marathon Digital Holdings (MARA), representing a massive 75.9% of the total portfolio.

What is the Price Prediction for CRPT ETF?

The average First Trust SkyBridge Crypto Industry and Digital Economy ETF price prediction of $16.40 implies 29.1% upside potential from current levels. Also, CRPT has a Strong Buy consensus rating on TipRanks, based on 27 Buys and five Hold ratings.

Key Takeaways

The above three crypto ETFs have solid potential to outperform once the crypto prices start picking momentum. Experts are forecasting a solid surge in crypto prices this year. Investors seeking to gain exposure to the crypto world can consider these ETFs as a safer and less expensive way to obtain diversification.