Regeneron (REGN) just scooped up 23andMe’s (MEHCQ) genetic database for $256 million in a bankruptcy fire sale—and Wall Street went wild. Shares of 23andMe soared 127% on the news, even as the deal raised major privacy red flags.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bankrupt consumer DNA testing company, once worth nearly $6 billion, is handing over millions of customers’ genetic information as part of a fire-sale acquisition that now has privacy advocates sounding the alarm.

Regeneron Scoops Up 23andMe Biobank and Services

The deal, announced Monday, includes 23andMe’s Personal Genome Service, Total Health and Research Services, and its entire biobank. That biobank holds not just DNA samples, but the deeply personal data of millions of users who once mailed in saliva kits thinking they were just tracing their ancestry.

Now, that data belongs to a pharmaceutical giant with plans to expand into personalized medicine.

Regeneron Promises to Protect Genetic Data

Regeneron says it will uphold existing privacy agreements. Still, a court-appointed privacy ombudsman is reviewing the transaction and expected to deliver a report by June 10. That hasn’t stopped public concern from bubbling up.

The unease is well-earned. Back in 2023, 23andMe suffered a devastating data breach that exposed sensitive genetic information on over 7 million users. The fallout helped push the company toward Chapter 11 bankruptcy earlier this year.

Regeneron Exploits Biotech Downturn to Lock in DNA Data

From a strategic lens, the deal is a bet on data-driven drug development. Regeneron gets access to one of the richest genetic datasets in the world — a potential goldmine for tailoring treatments and running high-speed genomic studies. At $256 million, it’s a steal, especially when you consider 23andMe’s former multibillion-dollar valuation.

But it also raises a thorny question: can personal data handed over in a health curiosity moment be used to drive profit for a drug giant? Legally maybe — but ethically, the debate is just beginning.

Shares of Regeneron saw a modest bump after the announcement. The acquisition is still pending bankruptcy court and regulatory approval, but it’s expected to close in Q3 2025.

Is Regeneron Stock a Buy Now?

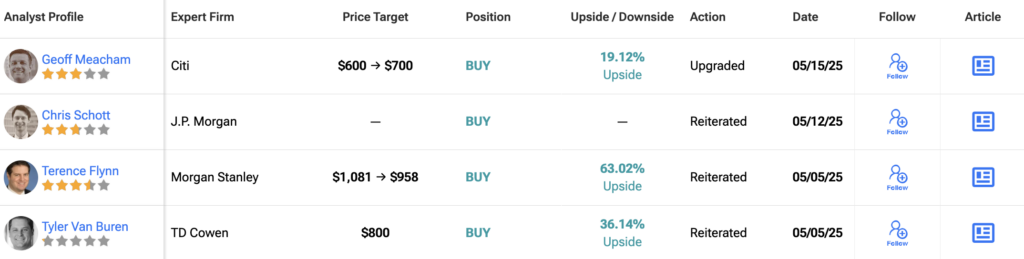

According to TipRanks, Regeneron is a Strong Buy across the board. Out of 21 Wall Street analysts, 18 rate the stock a Buy, with just two Hold and one lone Sell. The average 12-month REGN price target stands at $804.95, implying a 37% upside from the current share price of $587.64.