Tesla (NASDAQ:TSLA) stock has been in a tailspin in 2025, plunging nearly 50% year-to-date. While sluggish sales, weak delivery figures, and mounting concerns about a global economic slowdown have weighed heavily on the stock, those issues may not tell the whole story.

The real drag could be the growing backlash against CEO Elon Musk. Once hailed as a trailblazer, Musk is now drawing fire from all sides – not just for the increasingly political tone of his public activity, but also for what critics say is a wandering focus away from the businesses he’s supposed to be running.

It’s not the first time Musk’s outside ventures have shaken investor confidence. During his chaotic bid for Twitter (now X) in late 2022, Tesla shares lost roughly 30% — only to rebound in 2023 once Musk seemed to refocus on the core business.

One investor, known by the pseudonym Lily Investment Research, believes history is about to repeat itself – with big gains ahead for Tesla shares.

“Tesla looks well-positioned for a 2023 style recovery where it rose from the ashes following the ‘Twitter spiral,’” asserts the investor.

Lily notes that there have been plenty of indications that Musk will be leaving his DOGE role in the Trump administration. This would free him up to rededicate himself to driving Tesla’s growth catalysts, of which there seem to be plenty, according to the investor.

Among others, Lily mentions the ramp-up of the upgraded Model Y and the planned commercial launch of the company’s robotaxi service in June.

The investor notes that Tesla can be quite sensitive to “headline shocks,” and the on-time roll-out of the company’s robotaxi technology a few months hence would send a strong indication that TSLA is back on track.

Moreover, Lily is convinced that the depressed share price has already taken into account the worst-case scenarios for the company, leaving plenty of upside ahead once Musk leaves his governmental post and refocuses his energies.

“With Musk’s DOGE responsibilities nearing an end, Tesla stock’s turnaround should be right around the corner,” concludes Lily, who rates TSLA a Buy. (To watch Lily Investment Research’s track record, click here)

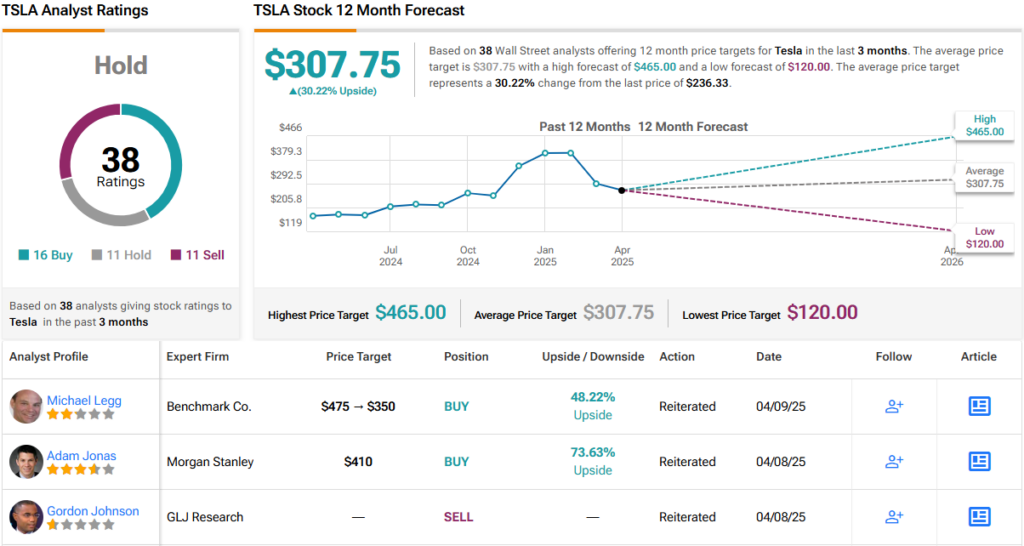

However, Wall Street isn’t revving up just yet. The Street remains split, with 16 Buys, 11 Holds, and 11 Sells — making TSLA a consensus Hold. Still, analysts see potential upside: the average 12-month price target sits at $307.75, implying a 30% gain from current levels. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.