Using the TipRanks’ Stock Screener Tool, we discovered 2 Best Canadian Penny Stocks that are highly favored by analysts. These two penny stocks have a Strong Buy consensus rating and could offer solid share price appreciation in the next twelve months. In Canada, a penny stock is defined as a company whose shares are trading at less than C$5 per piece.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Investing in penny stocks has its share of merits and demerits. An investor with a high risk-return appetite can consider penny stocks, as they have the capacity to generate enormous returns but are highly volatile.

With this background in mind, let’s understand more about the two penny stocks.

Illumin Holdings Inc. (TSE:ILLM)

Toronto-based Illumin Holdings is a technology company that provides marketers a full stack of powerful digital solutions to advertise across all ad formats and screens and extend their reach. The company’s proprietary AI-powered platform offers data-driven insights, real-time analytics, brand safety, and fraud prevention solutions.

Illumin is scheduled to release its Q2 FY24 results on August 8, before the market opens. Analysts expect the company to post a loss of C$0.04 per share on revenue of C$30.36 million. Remarkably, Illumin is witnessing solid demand for its self-serve platform for which revenues grew 282% year-over-year in Q1 FY24. The company is hoping to focus on growing the platform’s adoption from existing and new customers, thus boosting its revenue prospects.

Is Illumin Holdings a Good Investment?

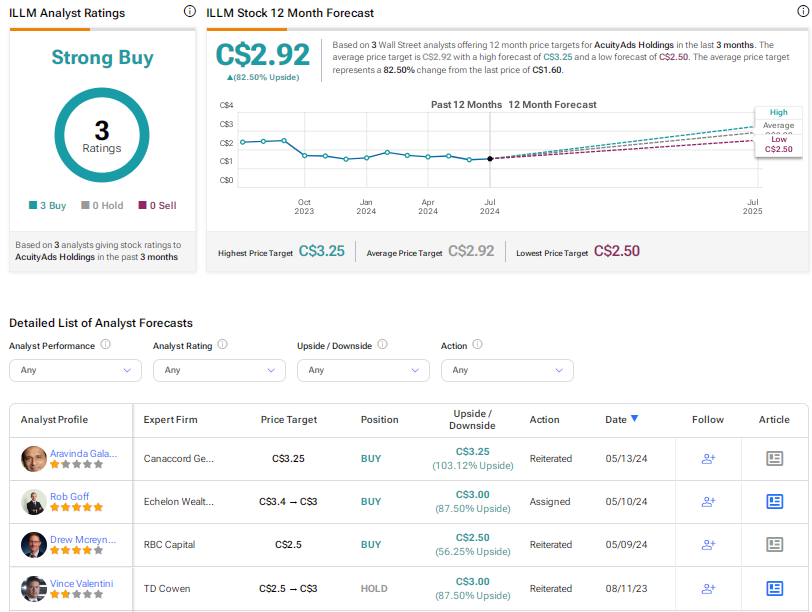

With three unanimous Buy ratings, ILLM stock commands a Strong Buy consensus rating on TipRanks. The average Illumin price target of C$2.92 implies 82.5% upside potential from current levels. In the past year, ILLM shares have lost 33%.

Haivision Systems, Inc. (TSE:HAI)

Montreal-based Haivision Systems provides mission-critical, real-time video streaming and networking solutions to broadcasters, businesses, and governments worldwide. The company offers high-quality, low-latency, and secure live video services at a global scale.

Haivision is expected to report its Q3 FY24 results in September. The consensus estimate for earnings per share is pegged at C$0.06 on revenue of C$34.48 million.

Importantly, the company is exiting the managed services business, thus moving away from an integrator model in the control room space. This business included lower-margin, third-party components. Instead, Haivision is focusing on becoming a manufacturer of proprietary products, which is poised to drive higher revenues in the long run.

Is Haivision a Buy?

With three unanimous Buys on TipRanks, HAI stock has a Strong Buy consensus rating. Also, the average Haivision Systems price target of C$7.40 implies 76.2% upside potential from current levels.

Ending Thoughts

Investing in penny stocks requires an understanding of the associated risks, such as volatility and potential losses. The two penny stocks discussed here could deliver solid returns, as reflected in analysts’ highly optimistic views. Investors seeking exposure to attractive penny stocks can consider them after thorough research.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue