Using TipRanks’ Stock Screener Tool, we selected the 2 Best Canadian Penny stocks to buy in July 2024, according to analysts. These two penny stocks have a Strong Buy consensus rating and could offer solid share price appreciation in the next twelve months. In Canada, a penny stock is defined as a company whose shares are trading at less than C$5 per piece.

Investing in penny stocks has its share of merits and demerits. An investor with a high risk-return appetite can consider penny stocks, as they have the capacity to generate enormous returns with their highly volatile nature.

With this background in mind, let’s understand more about the two penny stocks.

Exro Technologies, Inc. (TSE:EXRO)

Alberta-based Exro Technologies develops patented power electronics, hardware, and software solutions. Exro’s electronics solutions are aimed at reducing energy consumption in the transportation and energy sectors.

Exro is expected to release its Q2FY24 results sometime in mid-August. The consensus for earnings per share (EPS) is pegged at a loss of C$0.05, while revenues are at C$17.29 million. In the prior-year period, Exro reported a diluted loss of C$0.05 per share on revenues of C$2.44 million.

Importantly, on April 5, 2024, Exro completed the acquisition of California-based SEA Electric Inc. for C$332 million. The acquisition is expected to boost Exro’s revenues and technology offerings, as well as help turn the company towards profitability.

Is Exro Stock a Good Buy?

With three unanimous Buy ratings, EXRO stock has a Strong Buy consensus rating on TipRanks. The average Exro Technologies price target of C$1.54 implies an impressive 210.8% upside potential from current levels. In the meantime, EXRO shares have lost 61.3% so far this year.

Arizona Metals Corp. (TSE:AMC)

Ontario-based Arizona Metals Corp. is a mineral exploration company with a focus on gold, copper, silver, and zinc mining. Arizona Metals owns 100% of the Kay Mine Project and the Sugarloaf Peak Gold Project in Arizona.

AMC is expected to report its Q2 and half-year Fiscal 2024 results at the end of August. Arizona Metals is a pre-revenue company facing rising costs for exploring and evaluating its mines. The consensus for Q2 EPS is pegged at a loss of C$0.04, lower than Q2FY23’s loss of C$0.05 per share.

Arizona Metals is undergoing the spin-out of Sugarloaf Peak Gold Project and Kay Royalties to form two new companies, expected to be completed in Q2FY24. Following the spin-out, Arizona Metals will retain a 19.9% interest in both private companies, and the remaining shares will be distributed to existing shareholders on a pro-rata basis.

Is Arizona Metals Stock a Buy?

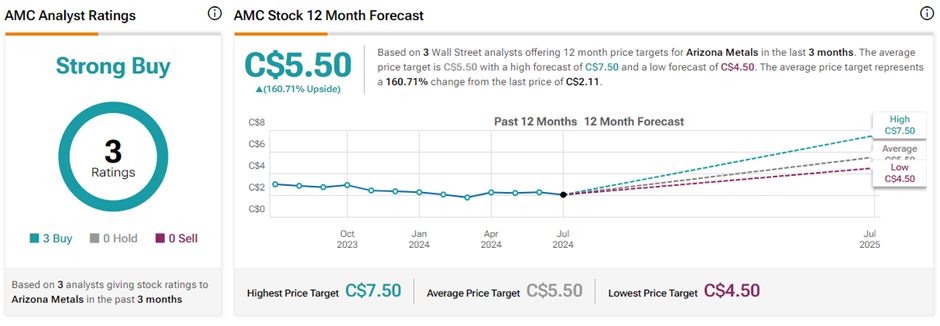

On TipRanks, AMC stock has a Strong Buy consensus rating backed by three unanimous Buy ratings. The average Arizona Metals Corp. price target of C$5.50 implies a massive 160.7% upside potential from current levels. Year-to-date, AMC shares have lost 13.5%.

Key Takeaway

Investors seeking exposure to penny stocks could consider the two Canadian stocks after thorough research. These stocks have the potential to generate outsized returns and have earned analysts’ bullish views.