Investors are pulling money out of the Treasury market following positive trade developments with the European Union and China over the weekend. The yield on the 10-year Treasury bond is up by about 40 bps, meaning that investors are selling bonds, likely in favor of riskier assets like stocks. Bond yields and bond prices carry an inverse relationship.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the direction of bond yields could become unpredictable this week. Several S&P 500 (SPX) companies will report their earnings, and the Fed will hold its policy decision meeting on July 29-30.

Fewer Trade Deals could Lower Yields

The August 1 deadline for countries to secure a trade deal with the U.S. is also approaching. Fortunately, the U.S. has made steady progress with key trading partners, such as the EU, China, and Japan. Other significant partners, like Canada and India, have yet to secure a deal.

A lack of trade deals contributes to economic uncertainty and could result in lower Treasury yields as investors seek safety by bidding up bonds. Weaker-than-expected earnings could also lead to lower yields.

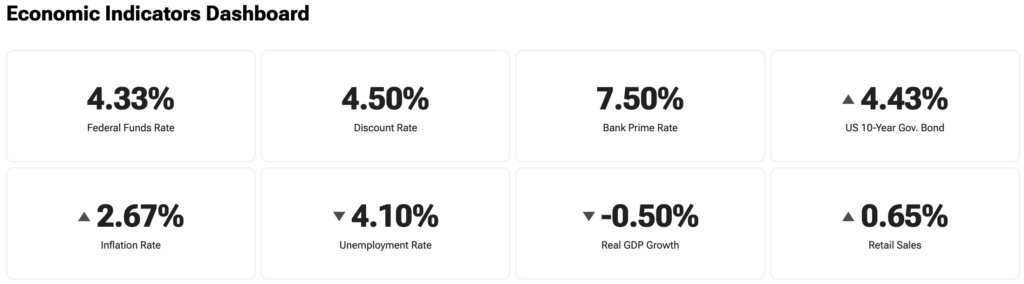

Track the 10-year Treasury yield and other key economic metrics with TipRanks’ Economic Indicators Dashboard.