Alphabet (GOOGL), better known as Google, is not everyone’s favorite search engine anymore. However, the stock remains one of the most compelling investment opportunities in Big Tech today. From dominating artificial intelligence (AI) to making headway in quantum computing, this legacy online giant is far more than a digital utility. It’s an innovation engine with staying power and growth potential that makes it a standout in any portfolio.

If you’re looking for an investment that offers reliable fundamentals and a real shot at transformative upside, Google stock is hard to beat. I remain bullish on the stock as falling prices improve my ability to establish a superb long-term position that will ultimately transcend the market’s short-term gyrations.

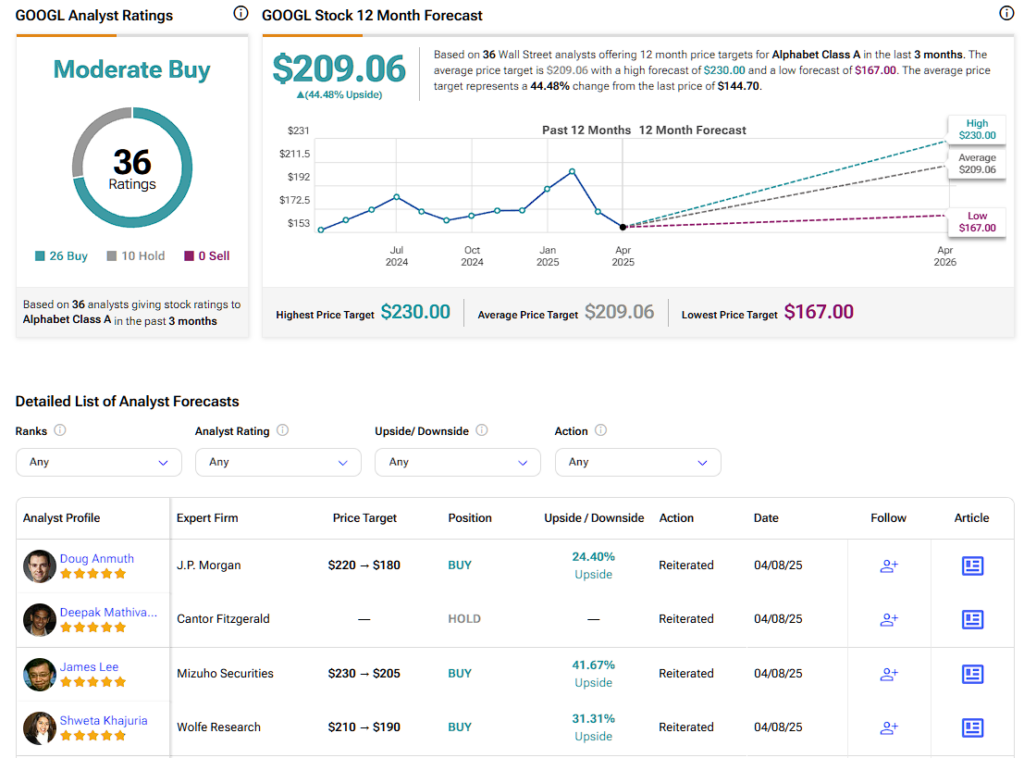

Following last week’s Trump tariff effects, several analysts have reiterated their Buy ratings on GOOGL stock this week, although some have stepped back from their $200+ price targets. Bullish sentiment remains strong while prices suffer the macro effects of trade war fears, which can only mean that GOOGL stock has become a ripened buy-the-dip opportunity.

AI Heavyweight with Quantum Upside

Google has already cemented its place as an AI frontrunner. AI isn’t just a side project—it’s built into almost every part of Google’s ecosystem. In 2024, the company poured nearly $50 billion into research and development, fueling its edge with custom AI chips and advanced neural network models. These aren’t just science projects—they’re already powering Search, YouTube, and Google Cloud. Every customer interaction with Google is AI-handled at some level of its deep infrastructure.

But the company isn’t stopping at AI. It’s betting heavily on quantum computing, a field still young but advancing quickly. Google’s latest quantum processor, Willow, successfully reduced error rates and solved previously unsolvable problems. One demonstration saw it complete a calculation in five minutes that would take a classical computer longer than “the age of the universe.” Combine that with its leading AI infrastructure, and you have a company that could dominate the next wave of computation.

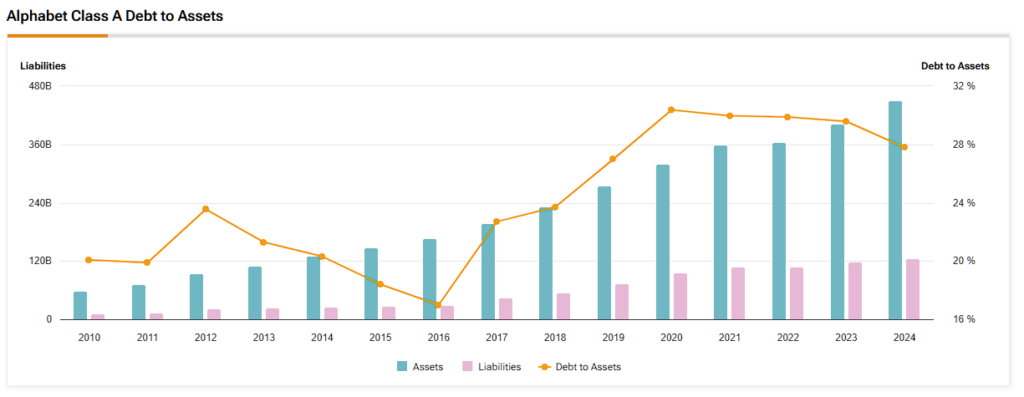

A fortress balance sheet backs all this ambition. Google generated over $125 billion in operating cash flow last year and sits on nearly $100 billion in cash and short-term investments. That means its high-risk, high-reward bets—like quantum computing—don’t threaten its core operations. When you invest in Google, you’re buying a well-oiled machine today, with exposure to some of tomorrow’s most promising growth areas.

Financial Power, Present and Future

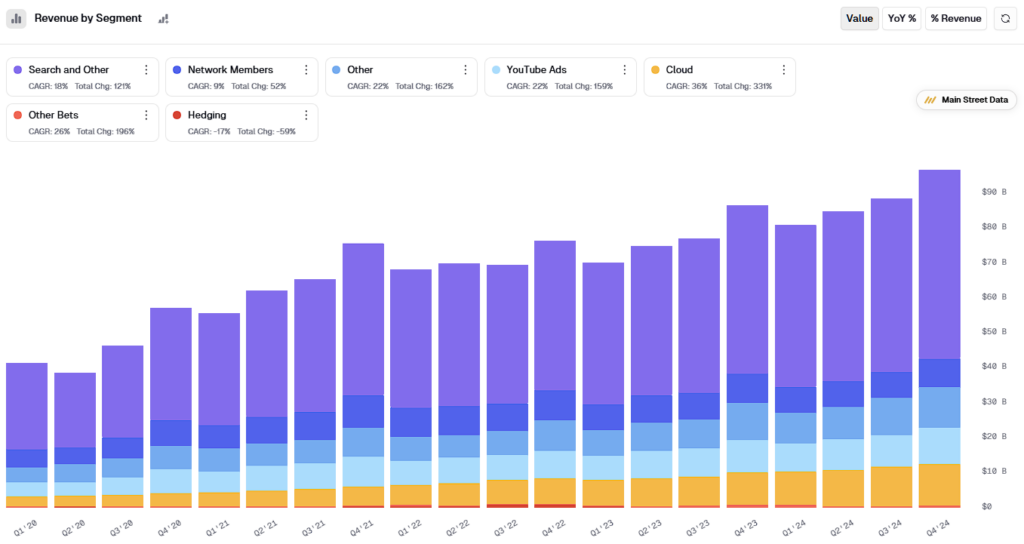

It’s not just the future that looks bright. Google’s latest financial results already reflect the impact of its AI push. In Q4 2024, CEO Sundar Pichai pointed out that performance was “driven by our leadership in AI,” with notable strength across Search, Cloud, and other divisions. One standout was Google Cloud, where revenue jumped 30% year-over-year—much of that tied to demand for AI-enabled services.

Of course, these results don’t come cheap. Capital expenditures in 2024 totaled $52.5 billion, aimed at expanding data centers and infrastructure to handle AI workloads. Meanwhile, quantum computing falls under Google’s “Other Bets” segment, which posted $1.65 billion in revenue for the year but still ran a $4.4 billion operating loss. Clearly, this side of the business is still in investment mode.

For 2025, Google expects capital spending to rise to around $75 billion as it continues building its AI infrastructure. This may sound aggressive, but it’s part of a larger strategy. Google acts like a tech conglomerate, deploying capital across various ventures—balancing mature, profitable businesses with bold plays on future technologies. This combination of financial discipline and long-term vision makes the company so compelling for investors who want both safety and growth.

Flattening Yield Curve Green Lights Tech Stocks

If you’re wondering whether now is the right time to buy into a company like Google, consider the broader economic backdrop. After years of inversion, the U.S. Treasury yield curve has finally flattened, suggesting that the worst may be behind us. In bond market terms, this is often an early sign of recovery.

Furthermore, the U.S. Federal Reserve appears close to shifting gears. Growth is already slowing—GDP is expected to rise by just 1.7% in 2025—and inflation is easing. Market expectations currently price in a Fed funds rate of around 3.5% by the end of the year. That would mark a meaningful decline from recent levels and could help jumpstart economic activity.

If rate cuts begin in the second half of 2025, stocks will likely rally in anticipation. In short, now is the moment to deploy capital—before the broader market picks up on the trend. Google stands to benefit more than most. Over the next decade, two words will define market leadership: AI and robotics. Google isn’t just participating in this trend—it’s leading it. Investors may regret skipping on the stock due to short-term macro concerns. Transitory noise shouldn’t cloud the bigger picture.

Is Google a Buy, Hold, or Sell?

Google currently holds a consensus Moderate Buy rating. Of 36 analysts covering the stock over the past three months, 26 are bullish, and 10 are neutral. Not a single analyst is currently bearish. The average twelve-month GOOGL price target is $209.06 per share, implying a potential upside of ~45%.

On average, Wall Street has a bold forecast but not outlandish. High-quality growth stocks like Google are poised to lead the next leg of the market recovery as interest rates come down and macro concerns ease. Unless we’re hit with a severe global shock—like a Taiwan hot war—the odds favor strong performance ahead. I believe the market is nearing a bottom, and we’ll see a turn in sentiment within the next few weeks.

Why Waiting Might Cost You

So, is now the time to buy Google? In my view, the answer is a resounding yes. With interest rates set to fall and the economy gradually regaining its footing, the setup for long-term investors looks increasingly attractive. Those waiting for perfect clarity may end up missing the temporary discount window.

Google offers a rare investment profile that combines present-day strength with the possibility of transformational upside. Between its rock-solid core businesses, industry-leading AI capabilities, and bold moves into quantum computing, this stock is positioned for long-term outperformance. Missing out now could generate the kind of regret that lingers.