President Donald Trump dealt a major blow to movie stocks on Monday after he proposed a massive 100% tariff on foreign films. The President said Hollywood is “dying a fast death” as other countries lure filmmakers away from the U.S. with tax incentives and lower production costs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

With this declaration, President Trump authorized the Commerce Department and the U.S. Trade Representative to draft plans for a 100% tariff on foreign movies. It’s unclear how this tariff will be applied to current films and what it means for streaming services, such as Netflix (NFLX).

One union told BBC that a 100% tariff on foreign films would be a “knock-out blow” to the industry. Hollywood is already suffering as increased production costs inflate film budgets, making it harder to score wins. A recent example of this is Disney’s (DIS) Thunderbolts, which pulled in $162.1 million from its opening weekend, compared to a $180 million budget.

Entertainment Stocks Fall Today

President Trump’s planned 100% tariff on foreign movies didn’t sit well with filmmakers on Monday. That saw several entertainment stocks drop in early morning trading, as investors absorbed the news. The lack of details around the tariffs has also spread to streaming services and movie theater chains.

Here’s the movie and entertainment stocks falling today.

- Disney — -3.35%

- Paramount Global (PARA) — -3.06

- Warner Bros (WBD) — -3.75%

- Comcast (CMCSA) — -0.64%

- Netflix — -5.04%

- Cinemark (CNK) — -5.94%

- AMC Entertainment (AMC) — -1.49%

Are Entertainment Stocks Still Worth Buying?

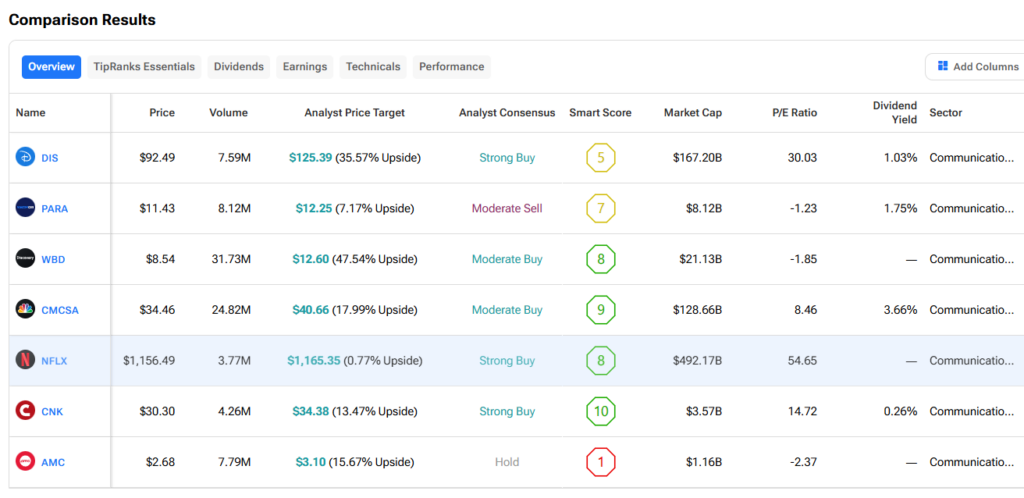

Turning to the TipRanks stock comparison tool, traders can see all the latest details on entertainment stocks. Of those listed above, DIS, NFLX, and CNK have consensus Strong Buy ratings. Looking at these three, Disney stock offers the best upside potential at 35.57%, followed by Cinemark stock at 13.47%, and Netflix stock only offers a slight 0.77% possible upside.