Transocean (RIG), an international provider of offshore contract drilling services for oil and gas wells, looks to benefit from the US government’s plan to strengthen the country’s energy supply and cut costs for homes and businesses. The recent decision by President Trump to reopen vast tracts of land for offshore oil and gas leases could be particularly beneficial. Transocean, which runs one of the world’s highest-specification floating offshore drilling fleets, has recently clinched several contracts in the Gulf of America. The potential boost to the company comes against a backdrop of some financial turbulence, with net income sitting at $7 million for the three months ended December 31, 2024. The upbeat outlook has helped to spark a rally in the shares, sending them up 8.76% in the past week.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Leveraging its Backlog

Transocean is a foremost global provider of offshore contract drilling services for oil and gas wells, working in technically challenging parts of the offshore drilling sector, such as ultra-deepwater and harsh environment services. The company has ownership, full or partial, in a fleet of 34 mobile offshore drilling units, which include 26 ultra-deepwater floaters and eight harsh environment floaters.

The company recently released its Q4 2024 financial report, with contract drilling revenues seeing a sequential increase of $4 million to $952 million. Adjusted net income for the same period stood at $27 million. Compared to the previous quarter, operating and maintenance expenses were higher by $16 million at $579 million. Cash provided from operating activities rose to $206 million in Q4, marking a $12 million increase from the previous quarter. The full-year net loss for 2024 stood at $512 million.

Transocean reported a $2.4 billion backlog as of the end of the year. Management has indicated its focus will be on converting the backlog into cash, allowing the company to continue de-leveraging its balance sheet.

Analysts Take a Cautious View

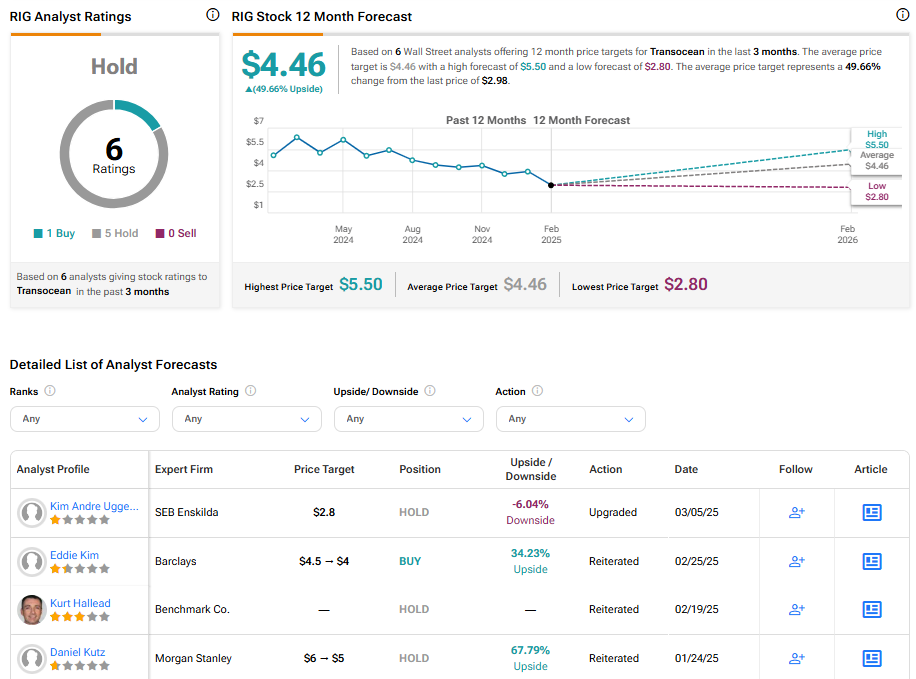

Analysts following the company have taken a cautious outlook on the stock. For example, Barclays’ Eddie Kim has lowered Transocean’s share price target to $4 (from $4.50) while maintaining an Overweight rating, noting Q4’s results. Despite the near-term volatility, management remains optimistic for 2026 and 2027, expecting contracts to increase around mid-year. Kim, however, expresses concerns regarding pricing and foresees elevated risk due to potential negative data in the upcoming months.

Transocean is rated a Hold overall, based on the recent recommendations of six analysts. Their average 12-month price target for RIG stock is $4.46, which represents a potential upside of 49.66% from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue