Toyota (TM) warned investors that U.S. tariffs will have a major impact on its profits. According to an earnings forecast from the automobile company, it suffered a tentative $1.3 billion impact to profits in April and May due to President Donald Trump’s tariffs, which include 25% on foreign car imports.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Toyota Chief Financial Officer Yoichi Miyazaki noted that trade war negotiations are still ongoing. As such, it’s “very difficult to forecast the future.” However, this could result in Toyota lowering its shipments to the U.S., as it shifts focus to selling cars in markets not affected by tariffs.

While Toyota’s profit warning may have spooked investors, it’s earnings data was welcome. The company posted adjusted earnings per share of $3.60 alongside revenue of $86.28 billion. These were above Wall Street’s estimates of $2.79 per share and revenue of $80.36 billion. Steady demand for Toyota vehicles fueled this win, with Fiscal 2025 vehicle sales of 9.362 million units, compared to 9.443 million in Fiscal 2024.

How Are TM Shareholders Taking the Tariff News?

TM stock was down early this morning after the earnings report was released. However, the stock has recovered from that initial dip. Now, the company’s shares are up 0.91%, easing a 1.82% loss year-to-date. The company’s strong earnings beat for Q1 likely helped its shares bounce back from the initial tariff scare this morning.

Is TM Stock a Buy, Sell, or Hold?

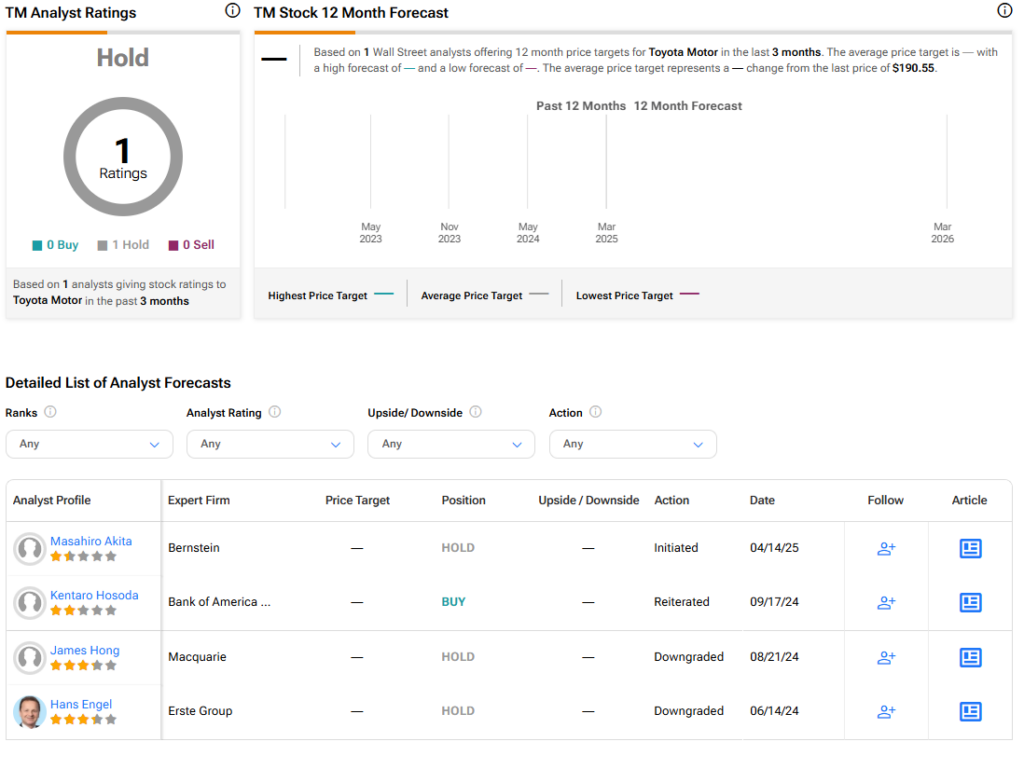

Turning to Wall Street, only one analyst has covered Toyota in the last three months. Bernstein’s Masahiro Akita has a Hold rating for TM stock. The lack of coverage also means there’s no average price target for investors to evaluate. However, this could change as analysts reevaluate the company after its latest earnings report.

See more TM stock analysts ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue