AI stocks are all the rage these days. And one of the hottest stocks in the red hot AI sector so far this year has been SoundHound AI (NASDAQ:SOUN), the Santa Clara, California-based company that’s developing AI solutions for voice applications that can be used in TV, Internet of Things, and customer service.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Just since the beginning of February alone, SoundHound stock has rocketed 420% in price. What’s more, SoundHound achieved these gains despite missing on earnings at the end of February. How did it do that?

Well, while SoundHound missed on earnings, it still had plenty of good news to report. Full year 2023 sales grew 47%, and gross margins were up six full percentage points versus 2022, helping to cut per-share losses nearly in half, to $0.40 per share. SoundHound’s performance in Q4 in particular was particularly good, with sales growth accelerating to 80%, and gross margins again gaining six percentage points – but ending at 77%, two points better than its gross margin for the year.

Oh, and losses were more than halved year over year in Q4 – just $0.07 per share.

Numbers like those are bound to attract attention on Wall Street, and in SoundHound’s case they did just that. A couple weeks after earnings, SoundHound sat down for in-person meetings with DA Davidson’s Gil Luria, a 5-star analyst rated in the top 4% of the Street’s stock pros.

So what do you need to know about it?

As Luria describes, SoundHound has a “three pillar” strategy for growing its business – three major streams of revenue coming into it. The first of these is royalty payments for each unit of technology (be it a car, a television, or something else) that makes use of SoundHound’s voice AI capabilities. SoundHound owns 25% of this market, and these royalties currently make up 90% of its revenue base.

SoundHound’s second pillar, or revenue stream, is businesses paying for subscriptions to access SoundHound voice AI capabilities. The company cited restaurant chains White Castle and Jersey Mikes as two such customers that are using SoundHound to power order-taking at their drive-thrus. Last year, such voice AI subscriptions made up less than 10% of SoundHound’s revenue base – but the company expects that percentage to more than double in short order (pun intended).

Third and finally, SoundHound is working to build a third pillar of revenue by connecting its first two pillars. Essentially, the company wants to use voice AI to empower its car-driver customers to place drive-thru orders directly to its restaurant customers – before they even get to the restaurant. The company’s purchase of SNYQ3 Restaurant Solutions, announced in December 2023, will kickstart growth of this newest pillar through its existing relationship with 10,000 restaurants nationwide, “including every Chipotle nationwide” (emphasis added).

Eventually, SoundHound expects each of these three pillars to grow into a $1 billion-plus business, at which point each will comprise approximately 33% of the company’s revenue stream – quite a jump from SoundHound’s current status as a $46 million-a-year-business getting 90% of its revenues from Pillar 1 alone.

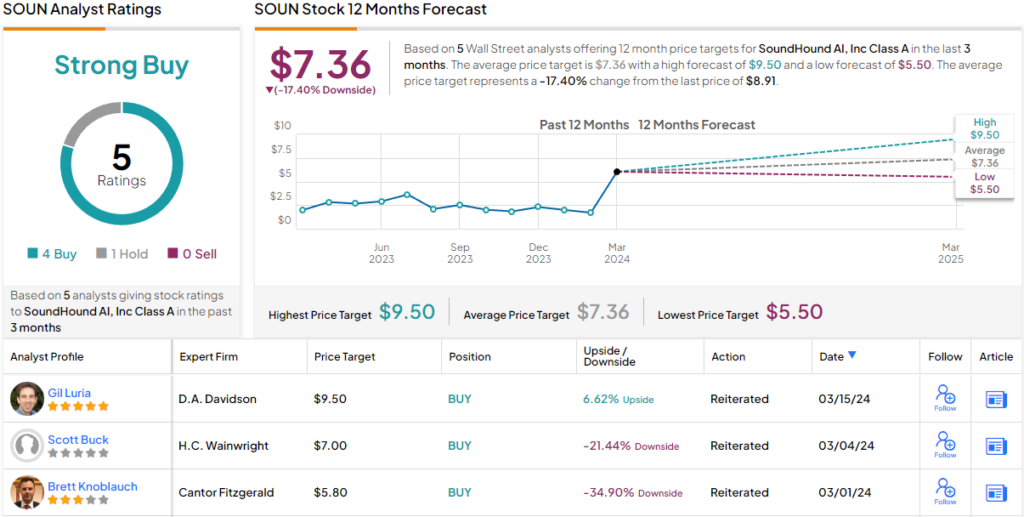

It’s in anticipation of that day that Luria is recommending that investors “buy” SoundHound stock, which he values at $9.50 per share. (To watch Luria’s track record, click here)

So, that’s DA Davidson’s view, what does the rest of the Street have in mind? The current outlook offers a conundrum. On the one hand, based on 4 Buy ratings and just 1 Hold, the stock has a Strong Buy consensus rating. However, after soaring so high this year, the analysts expect shares to cool down and anticipate downside of 17% over the coming months.

It will be interesting to see whether the analysts upgrade their price targets as they strive to match SOUN’s continuous rally. (See SOUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue