Electric vehicle (EV) maker Tesla (TSLA) is drawing attention with its proposed low-cost EV, as global sales of its autos continue to decline. Last year, CEO Elon Musk already canceled plans for a $25,000 EV, called Model 2. However, the company has since been promoting ideas of launching a more “affordable” EV this year to beat the competition and expand its market share.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

This year, Tesla’s auto sales in China were ousted by domestic player BYD (BYDDF). Moreover, Musk’s political inclinations sparked dramatic protests and criticism, which ultimately led to weakening sales of Tesla’s EVs globally, especially in European markets.

The History of Tesla’s Low-Cost EV

When a Reuters report dated April 5, 2024, claimed that Musk had canceled the $25,000 EV project, Musk immediately commented on his X account saying “Reuters is lying.” His response took investors by surprise, leaving many wondering why he was disputing widely known facts. Frantic investors questioned whether Musk had changed his mind, but Musk confirmed that the project was indeed dead.

The new affordable EV was expected to be launched in the first half of 2025, but no specific details have been released yet. The only known information is that Tesla plans to produce stripped-down versions of Model 3 and Model Y, which will be “affordable” and consumers would be able to buy them.

Since the second half of last year, Musk’s attention has been divided between his political activities, including his role in leading the infamous DOGE (Department of Government Efficiency) committee and running his business ventures. Tesla faced massive criticism for the CEO’s involvement in laying off government staff, which also hurt the company’s sales. However, Musk announced last week that he is leaving his role as advisor to the U.S. President Donald Trump and will now refocus his full attention on his companies.

Musk’s Pay Deal Hangs in the Balance

Musk’s non-business endeavors have also cost him financially. In 2024, he was the lowest paid CEO among the S&P 500 companies, receiving zero salary from his Tesla. Since 2018, his compensation is tied to Tesla’s overall performance and depends on meeting specific milestones related to market capitalization, revenue, and adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). He has several stock options that are contingent on achieving these milestones.

However, due to the company’s dwindling performance, some executives are considering awarding Musk a traditional CEO salary. It remains to be seen whether Musk’s full-time return will lead to a full-throttle boost in Tesla’s performance.

Is Tesla a Buy, Hold, or Sell?

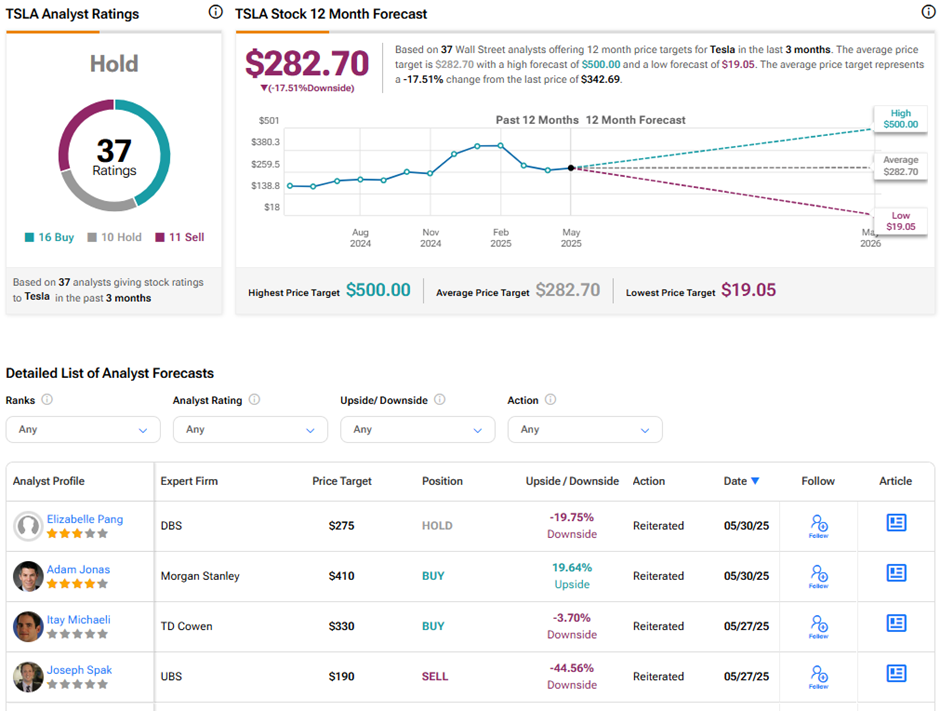

On TipRanks, TSLA stock has a Hold consensus rating based on 16 Buys, 10 Holds, and 11 Sell ratings. Also, the average Tesla price target of $282.70 implies 17.5% downside potential from current levels. Year-to-date, TSLA stock has lost 15.1%.