Tesla (NASDAQ:TSLA) stock surged ~6% on Tuesday, shrugging off concerns about the company’s international performance. New data showed Tesla’s European sales were slashed in half in April, while a renewed price war erupted in China’s competitive EV market.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Yet, the stock found support from improving broader market sentiment, fueled by President Donald Trump’s decision to postpone planned tariffs on the European Union until July, easing trade tensions that had weighed on global equities.

Investor enthusiasm was further stoked by CEO Elon Musk’s latest statement on X, where he announced he’s “back to spending 24/7 at work and sleeping in conference/server/factory rooms.” The move signaled a renewed operational focus, and markets responded favorably to the idea of Musk doubling down on Tesla’s core business rather than engaging in political distractions.

Meanwhile, Tesla’s big robotaxi launch is just around the corner. According to CEO Elon Musk, by the end of June, these driverless cars will be zooming across the streets of Austin, Texas.

This will be a big test for Tesla’s FSD (full self-driving) credentials, and the rollout’s success – or failure – could have huge implications for the stock.

Ahead of the launch, Truist’s William Stein, an analyst who ranks 4th among thousands of Wall Street stock analysts, has been conducting tests of his own. After previously test-driving Tesla’s FSD in August 2024 and January 2025 to get a feel for what might be on the way with Tesla’s version, he recently tried out Waymo’s service, taking a 24-mile ride from the Phoenix airport to a hotel.

The Waymo ride worked reliably overall – the app functioned like Uber’s, the car arrived on time, took Stein to the correct destination, and the $28 fare was a bargain. However, in prioritizing safety, Waymo significantly compromised speed and convenience: the 24-mile trip took 70 minutes, double the time estimated by Uber or a maps app, as the car stuck to local roads and drove cautiously, even bumping a curb on a sharp turn.

“Users might think they like the safety versus time/convenience trade off, but consider: would you regularly opt for a 2x as long trip?” Stein asks. While acceptable for research, the analyst thinks that such a slow ride wouldn’t be practical for everyday use.

So, how does this pertain to Tesla’s upcoming launch? “We found Waymo’s technology to be wonderful, but imperfect…materially,” the 5-star analyst explained. “Based on our experience with FSD, we expect TSLA’s Robotaxi service, scheduled to debut in June in Austin, will likewise be imperfect, but in different ways.”

Waymo, then, is “fun and interesting,” but not practical in its current form. Looking ahead to Tesla’s upcoming Robotaxi service, Stein sees two “potential outcomes”: the more probable is that Tesla mirrors its FSD approach – optimized for typical driving scenarios but with a higher risk of accidents. The less likely, though still possible, scenario is that Tesla prioritizes safety, resulting in a service resembling Waymo’s – so cautious that it’s “not fit for purpose.”

Still, that doesn’t mean the stock can’t enjoy a robotaxi-fueled bump. “We expect TSLA’s Robotaxi introduction, even at small scale, will be a positive catalyst for the stock,” Stein summed up.

However, does that make the stock a buy right now? Not quite, says Stein. The analyst is staying on the sidelines with a Hold (i.e., Neutral) rating and a $280 price target, suggesting the stock is currently trading 22% above where he sees fair value. (To watch Stein’s track record, click here)

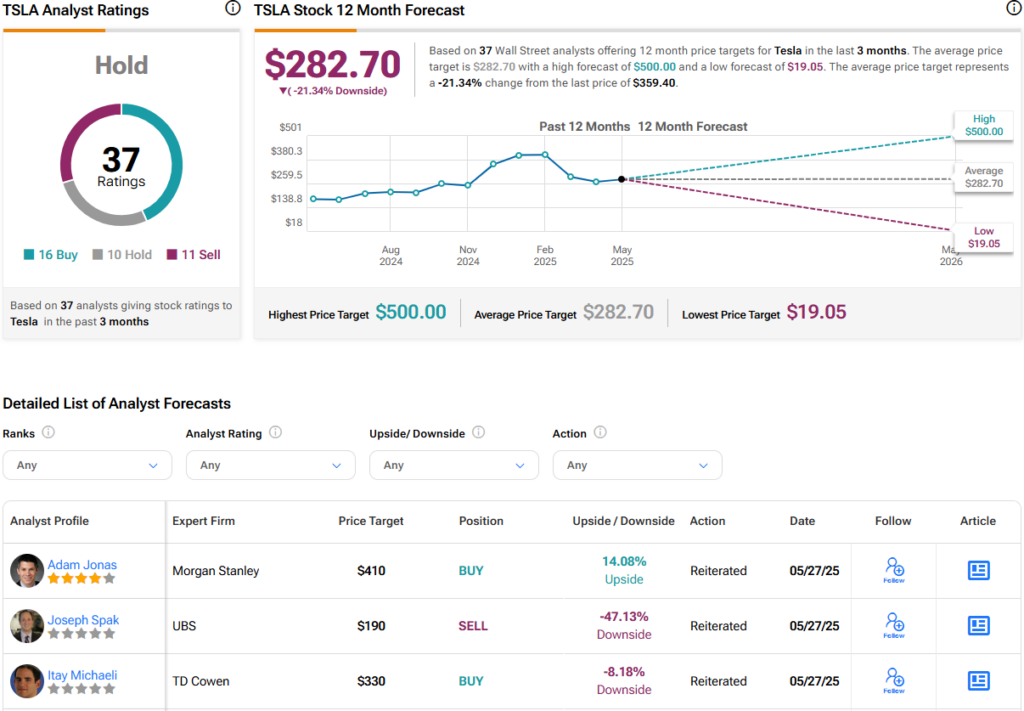

That view isn’t far off the Street’s broader stance. The consensus rating is also a Hold, based on 16 Buys, 10 Holds, and 11 Sells. The average price target of $282.70 points to a 21% downside over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue