T-Mobile (TMUS) announced on Friday that the U.S. wireless carrier plans to repurchase up to $14 billion worth of stock by the end of 2025. This is part of its broader initiative to return up to $50 billion to its shareholders over the next three years.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

TMUS Is Expanding its Stock Buyback Program

The company’s latest stock buyback program is in addition to its $19 billion shareholder buyback plan announced last year, which will run through the end of this year. Furthermore, the telecom major reiterated that it intends to allocate up to $80 billion in investments and capital returns through 2027. This includes up to $50 billion in stock buybacks and cash dividends, up to $20 billion in discretionary activities including reducing its debt, and another $10 billion to complete pending deals.

Looking ahead, T-Mobile expects its adjusted free cash flow to reach between $18 billion and $19 billion by 2027.

Is TMUS a Good Stock to Buy Now?

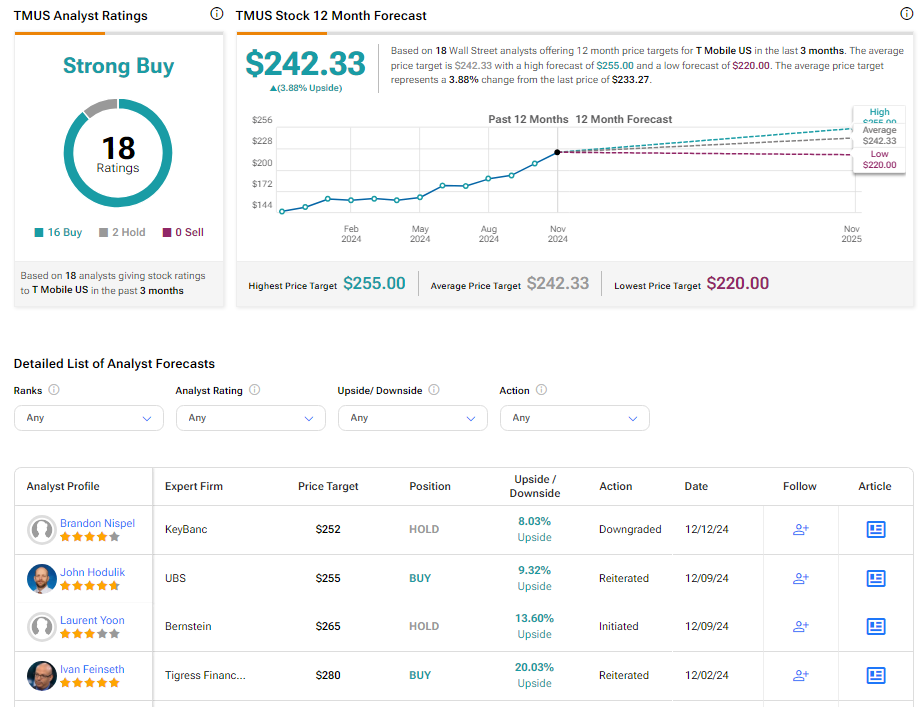

Analysts remain bullish about TMUS stock, with a Strong Buy consensus rating based on 16 Buys and two Holds. Over the past year, TMUS has surged by more than 40%, and the average TMUS price target of $242.33 implies an upside potential of 3.9% from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue