The rating for Super Micro Computer (SMCI) was recently downgraded by a Goldman Sachs analyst Michael Ng to Sell from Hold. Also, the Top analyst reduced the price target to $32 (implying a downside of 24.1%) from $40. Despite SMCI stock’s strong performance, up 38% year-to-date, the analyst views the current risk-reward balance as unfavorable.

Before moving ahead, it must be noted that Ng ranks 1,055 out of more than 9,400 analysts tracked by TipRanks. He has a success rate of 51% and has achieved an average return per rating of 9.8% in the past year.

Key Concerns Noted by the Top Analyst

The analyst has cited several factors that could impact SMCI’s market position and financial performance in the near term. These include:

- Rising Competition in AI Servers: The AI server market is growing more competitive as rivals boost R&D efforts, reducing product differentiation, and challenging SMCI’s strong position. This competition is likely to impact its market share and bottom line.

- Declining Gross Margins: SMCI’s gross margins will likely decline due to rising competition, the shift to Blackwell products, and pricing pressures from key customers and suppliers. Also, its reliance on a small number of customers and suppliers makes it more exposed to external pressures.

- Reduction in Valuation Premium: SMCI currently trades at a valuation premium compared to its peers, such as Dell (DELL). However, this premium is expected to narrow over time due to fewer unique features in its products and risks linked to customer and supplier concentration.

What Is the Forecast for SMCI?

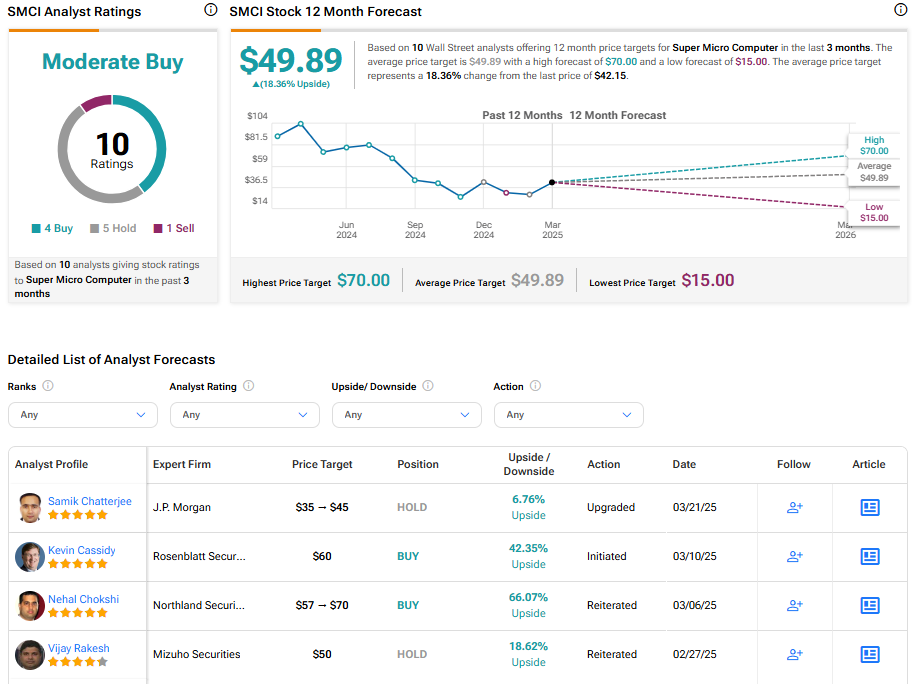

Super Micro Computer stock has seen mixed analyst opinions recently. On Friday, JPMorgan analyst Samik Chatterjee upgraded his rating to Hold from Sell and raised the price target to $45 from $35. The analyst upgraded SMCI, citing benefits from Nvidia (NVDA)-powered Blackwell servers driving revenue growth, but remains cautious about easing gross margins and limited EPS growth in Fiscal 2026 due to rising competition.

Overall, SMCI stock has a Moderate Buy consensus rating based on four Buys, five Holds, and one Sell assigned in the last three months. At $49.89, the average Super Micro Computer price target implies an 18.4% upside potential.