Three Strategy (MSTR) executives have bought the company’s new preferred stock.

The executives apparently took advantage of a comparatively cheap price for the stock and its hefty 12% dividend yield. Strategy sold 8.5 million shares of preferred stock at $85 each, below the initial price of $100. The deal raised $711 million for the company after fees. Strategy is a serial Bitcoin (BTC) acquirer and the largest corporate holder of BTC in the world, with 506,000 tokens worth $44 billion.

Strategy CEO Phong Le purchased 6,000 preferred shares at $85, while CFO Andrew Kang bought 1,500 shares, and general counsel Wei-Ming Shao purchased 500 shares, according to a filing with the U.S. Securities and Exchange Commission (SEC). Preferred shares are like a combination of bonds and stocks and offer a big dividend payout that yields a chunky 12% to shareholders.

Buying More BTC

The preferred stock offering is due to end on March 25 and expected to begin trading the next day on the Nasdaq exchange under the ticker symbol “STRF.” The new preferred stock could begin trading at a premium to the offer price, especially given its high yield. The new preferred stock cannot be converted into Strategy’s common stock.

Unsurprisingly, Strategy plans to use the money raised from the share sale to purchase more Bitcoin. The company just acquired an additional 6,911 Bitcoin, lifting its total cache of BTC above 500,000. A former software company, Strategy has morphed into a Bitcoin holding company under the direction of chairman Michael Saylor.

MSTR stock has risen 16% so far in 2025.

Is MSTR Stock a Buy?

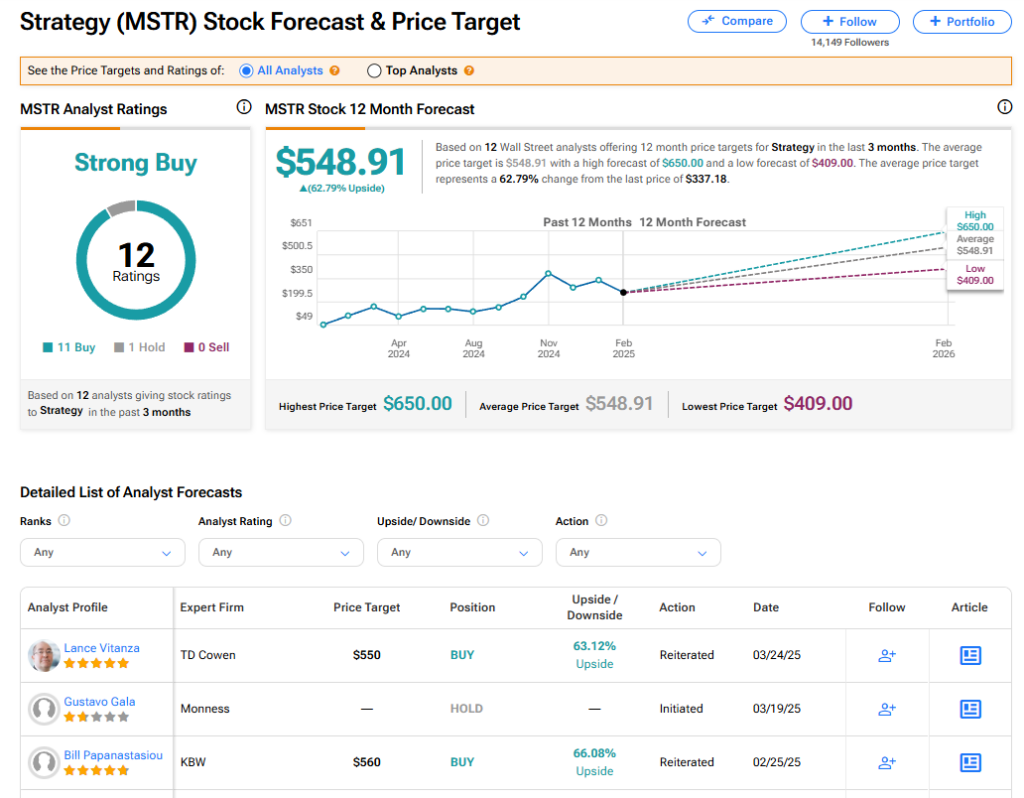

The stock of Strategy has a consensus Strong Buy rating among 12 Wall Street analysts. That rating is based on 11 Buy and one Hold recommendations issued in the last three months. The average MSTR price target of $548.91 implies 62.79% upside from current levels.