Michael Saylor’s Bitcoin crusade just hit a wall. Strategy (MSTR), the company that famously bet its future on Bitcoin, has paused new purchases—despite the token dipping below $87,000 last week. The move marks a rare moment of hesitation for the crypto giant, which also disclosed a jaw-dropping $5.91 billion unrealized loss in its latest SEC filing.

Bitcoin Slide Sparks First Pause in Months

According to a filing with the SEC, Strategy bought 22,048 Bitcoin between March 24 and March 30, spending $1.92 billion at an average price of $86,969 per coin. But the buying stopped cold as of March 31. The company added zero Bitcoin between March 31 and April 6—a stretch that saw Bitcoin fall to its lowest point in over five months.

It’s a big shift from the strategy of relentless accumulation that’s defined the company’s public identity. Bitcoin has slipped far below Strategy’s $67,458 average buy-in. Even Saylor’s diamond hands seem to be taking a breather.

Strategy’s Q1 Numbers Reveal Massive Paper Loss

The firm’s total Bitcoin holdings now sit at 528,185 BTC. That haul is deep in the red. Strategy reported an unrealized loss of $5.91 billion for Q1, though it’s been partially cushioned by a $1.69 billion income tax benefit. The company still expects to post a net loss.

That’s not stopping Saylor from sticking to the narrative. “Bitcoin remains the ultimate store of value,” he said in a recent X post. But investors aren’t quite as zen. Shares of Strategy dropped 10.2% following the filing.

Furthermore, Strategy recently issued $1 billion in new convertible notes. Market confidence is now critical, and some warn that dilution risk could climb if the crypto downturn continues.

Is MSTR Stock a Buy Right Now?

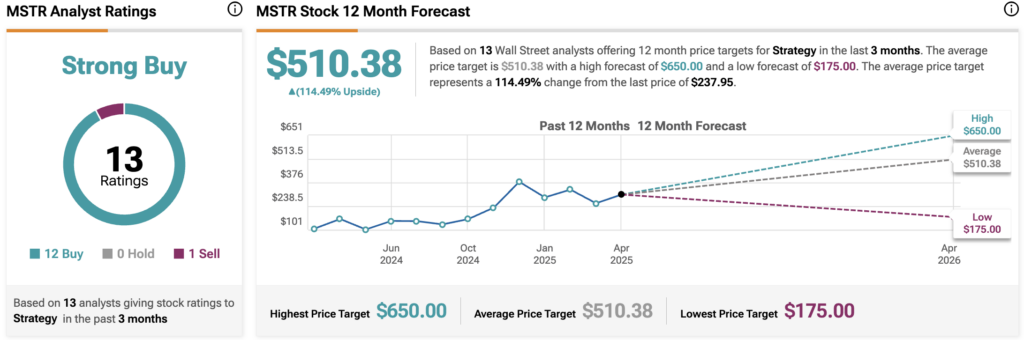

Overall, Wall Street remains optimistic about MSTR stock, with a Strong Buy consensus rating based on 11 Buys and one Hold. However, analysts at Bank of America Securities and Wedbush flagged concerns that deeper drops in Bitcoin could weigh on the company’s liquidity and financing plans. Over the past year, MSTR has increased by more than 60%, and the average MSTR price target of $510.38 implies an upside potential of 114.5% from current levels.