The Democratic Republic of Congo (DRC) opens the door to satellite Internet, and Elon Musk’s Starlink aims to make the most of it, officially unlocking satellite Internet for one of Africa’s most underserved nations. After previously banning Starlink over security worries, Congo’s government has now granted the company a license to operate, just as it holds talks with the U.S. over a minerals-for-security partnership. Starlink will begin offering service to the country’s 115 million people “in the coming days,” according to the Congolese telecom regulator.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The timing isn’t accidental; Congo has one of the world’s lowest mobile internet penetration rates, with only about 31% of people accessing the World Wide Web by the end of 2023. And in the war-torn eastern part of the country, where a Rwanda-backed rebel group is active, reliable internet is almost non-existent. The government originally feared insurgents could misuse Starlink. But now, with tighter regulations and an eye toward economic development, it sees Starlink as a game-changer for education, business, and communication.

Big Growth Ahead, but Some Bumps on the Road

For Starlink, this isn’t just a moral win, it’s a financial one. Congo adds a huge, untapped market to the company’s growing footprint in Africa. Analysts believe Starlink’s business on the continent could top $1 billion in revenue by 2030, and Congo will likely be a big part of that growth. The demand is there, but affordability remains a hurdle. At nearly $600 cost for the hardware kit, many Congolese will need help getting started, which may require government or NGO partnerships.

Still, this move strengthens Starlink’s lead as Africa’s most widely available satellite internet provider. With competitors like OneWeb trying to catch up, Starlink’s early start and rapid expansion give it a serious edge. In a market set to nearly double by 2029, Starlink’s bet on Africa could pay off big for both the company and the people it connects.

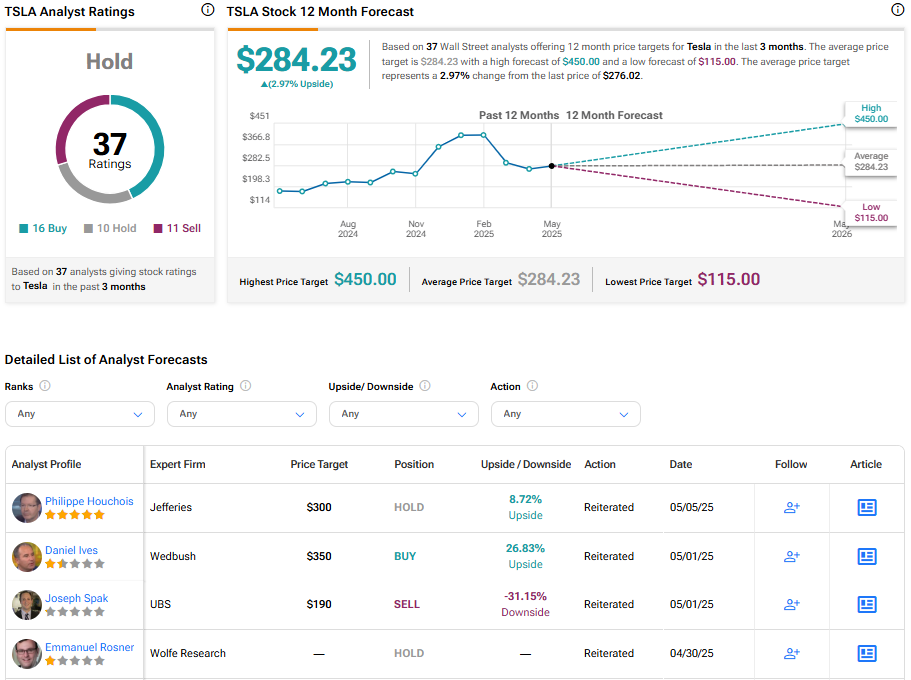

Is Tesla Stock a Buy, Hold, or Sell?

Of course, Starlink is still a privately held company, so let’s see how Musk’s publicly traded company, Tesla, fares with Wall Street analysts these days. Tesla sports a Hold rating, based on 37 analysts, with an average price target of $284.23. This implies a 2.97% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue