The stablecoin market is on the brink of a $2 trillion transformation. Looming U.S. legislation could send supply soaring and bring stablecoins firmly into the financial mainstream.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

According to a new report from Standard Chartered (GB:STAN), a 10x surge could be coming—taking the total stablecoin supply from $230 billion today to a jaw-dropping $2 trillion by the end of 2028. The trigger? A little thing called the GENIUS Act.

Genius Act Could Legitimize the Entire Industry

Short for the Guiding and Establishing National Innovation for U.S. Stablecoins Act, the GENIUS Act is expected to pass Congress in the coming months. Once signed by President Trump—who’s made no secret of his bullish stance on digital innovation—it would lay down clear legal ground rules for stablecoin issuers. That includes stricter reserve backing, better disclosures, and official audits.

According to Standard Chartered analysts led by Geoff Kendrick, this regulatory clarity would “further legitimise the stablecoin industry” and unlock massive institutional adoption.

$2 Trillion Market? Here’s the Math

That kind of legitimacy matters. Especially when the report estimates the stablecoin supply could multiply nearly tenfold in just three years. To make that leap, issuers would need to snap up $1.6 trillion worth of short-term U.S. Treasuries. That’s not just big—that’s enough to soak up the entire planned issuance for the rest of Trump’s second term.

And it wouldn’t just be crypto firms benefitting. That level of demand would also reinforce the U.S. dollar’s global dominance, as stablecoins are typically backed by dollar-denominated assets.

Circle and Tether Set the Blueprint

As regulators size up the stablecoin sector, two giants are already laying the groundwork. Circle, the firm behind USDC (USDC-USD), holds 88% of its reserves in short-term U.S. Treasury bills with an average duration of just 12 days. That model — transparent, dollar-heavy, and ultra-liquid — is quickly becoming the gold standard.

Tether’s no slouch either. The company behind USDT (USDT-USD), the world’s largest stablecoin, holds 66% of its reserves in T-bills. That means nearly two-thirds of USDT is backed by U.S. government debt — and that number could rise as legislation takes shape.

According to Standard Chartered, this shift toward heavily collateralized reserves should reassure lawmakers and help legitimize the sector. It also links stablecoins directly to broader financial plumbing — from liquidity flows to Treasury demand — in a way we haven’t seen before.

Can You Track Stablecoins – Even If They Are Stable?

In a market where sentiment can shift by the hour, it pays to keep tabs on stablecoins. Assets like USDT and USDC may hold their $1 peg, but behind that calm surface lies a torrent of useful data — volume spikes, liquidity shifts, and real-time flows into crypto and DeFi.

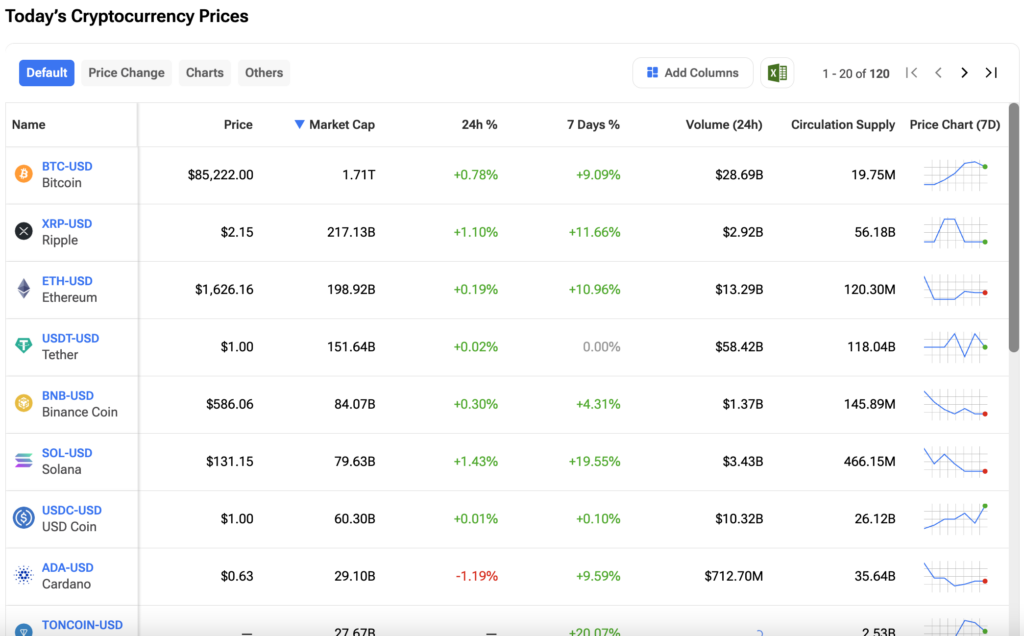

With TipRanks’ Cryptocurrency Center, investors can track key stats like 24-hour trading volume ($58.4B for USDT and $10.3B for USDC), market cap, circulating supply, and short-term price dynamics. These aren’t just numbers — they reflect trust, usage, and risk sentiment across the entire crypto economy.

Click the image below to dive deeper and see how these dollar-backed giants are moving.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue