European stocks are rallying on news that inflation across the continent dipped to an annualized rate of 2.2% in March from 2.3% recorded in February of this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Data from statistics agency Eurostat shows that core inflation, which excludes more volatile food, energy, alcohol and tobacco prices, declined to 2.4% in March from 2.6% in February. Closely watched services inflation, which had been stuck near 4% for months, fell to 3.4% in March.

Among major economies, March inflation came in at 2.3% in Germany, 2.2% in Spain, and was unchanged at only 0.9% in France. The latest inflation reading has bolstered expectations that the European Central Bank (ECB) will lower interest rates at its next meeting on April 17. That expectation has European indices rising, along with leading stocks such as Spotify (SPOT), Birkenstock (BIRK) and Ferrari (RACE).

Lower Rates a Positive Development

Futures traders are now pricing in an 80% chance of an interest rate cut by the European Central Bank in April. The decline in services inflation is especially positive and raises the chances of an interest rate cut, say economists and analysts.

Separate data showed that the unemployment rate in Europe in February declined to 6.1% from 6.2% at the start of the year. Unemployment usually declines in low-interest rate environments as businesses can boost their workforces amid cheap borrowing costs.

Despite the positive inflation and unemployment readings, the European Union is bracing for tariffs of up to 25% from the U.S. in coming days. Economists have warned that U.S. duties on European goods are likely to be inflationary for the continent. The European Union has said that it plans to implement targeted retaliatory tariffs in response to America’s actions.

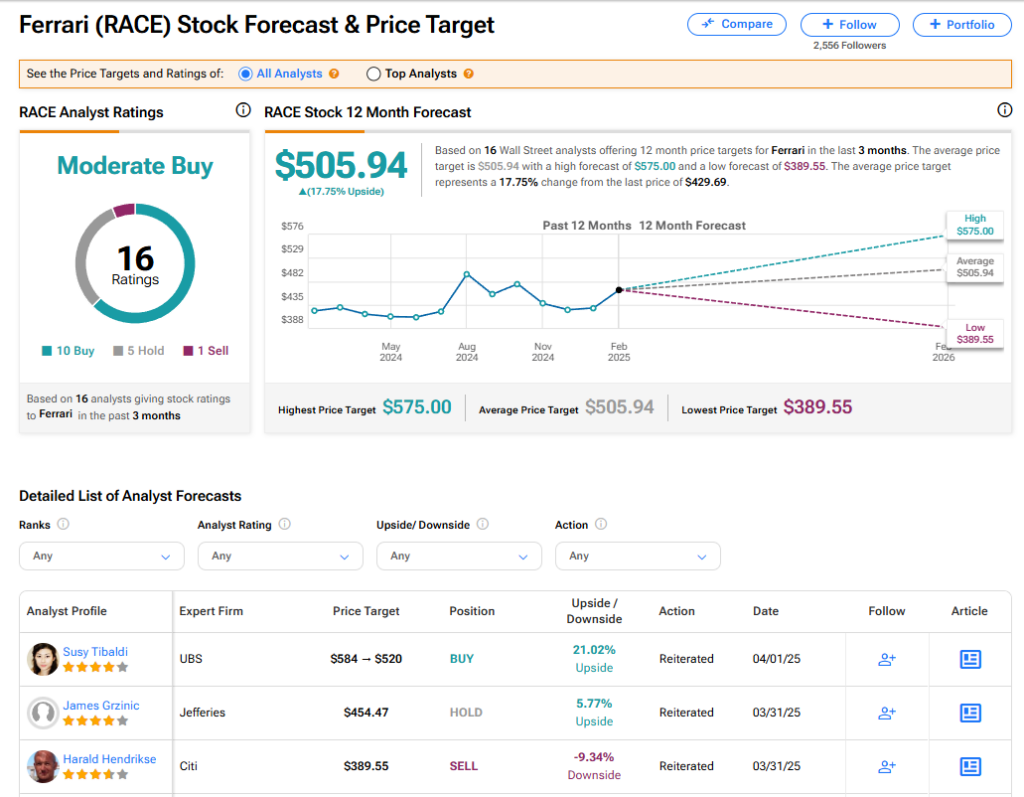

Is RACE Stock a Buy?

The stock of Italian sports car maker Ferrari has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on 10 Buy, five Hold, and one Sell recommendations issued in the last three months. The average RACE price target of $505.94 implies 17.75% upside from current levels.