Sports betting stocks could see increased interest from investors during the Thanksgiving holiday weekend. This is because it’s predicted to witness high sports betting activities that could set new records. Indeed, the holiday weekend will see a slew of football action, including classic college rivalry games and the first-ever Black Friday NFL Game, which will likely stoke a rise in sports betting activities.

Sports betting app downloads have risen significantly, with the recently launched ESPN Bet from Penn Entertainment (NASDAQ:PENN) in the lead. While ESPN Bet saw over 1.1 million downloads, apps like Flutter Entertainment’s Fanduel and DraftKings (NASDAQ:DKNG) saw more than 130K downloads for the week.

How Much Money is Bet on Sports in the U.S.?

The American Gaming Association’s data shows that sports betting has increased significantly. Per the report, Americans could spend around $100B this year. During the third quarter, the AGA stated that Americans bet $23B on sports, a 32.7% increase year-over-year.

Similarly, sports betting revenue for operators has also spiked significantly, rising 22.8% year-on-year to $2.15B in Q3 and 51% on a year-to-date basis through September 30. “The notable rise in betting volume, surpassing revenue growth, hints at an evolving, engaged betting community,” stated U.S. sports betting analyst Matt Speakman.

Indeed, DraftKings continues to be a clear market leader in the industry. The stock has also recorded a remarkable performance this year, rising by 250%. In addition to a surge in sports betting interest, the company’s push toward profitability also lured investors back in.

Morgan Stanley analyst Stephen Grambling predicts DraftKings will remain a market leader. However, newer entrants could put pressure on its market share.

What are the Best Gambling Stocks to Buy?

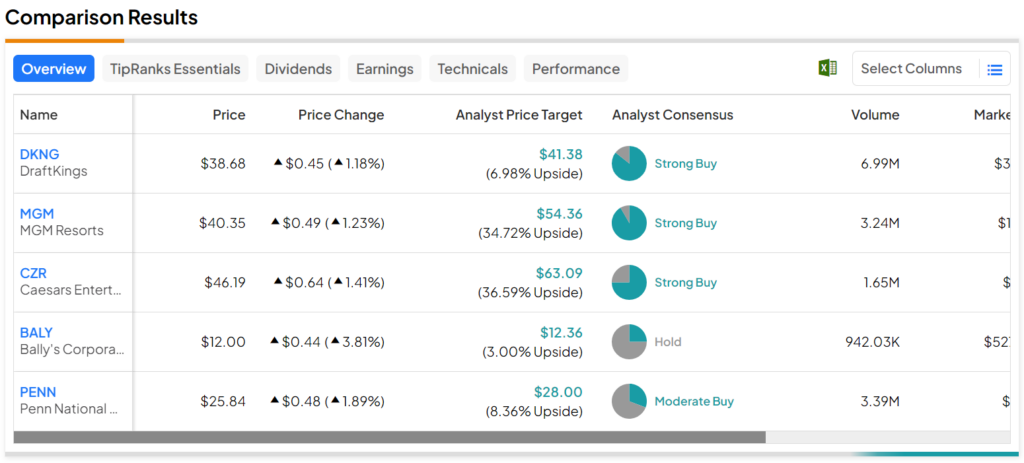

Turning to Wall Street, CZR stock remains the leader in upside potential here. This Strong Buy-rated stock offers 36.6% thanks to its average price target of $63.09. On the other hand, with an average price target of $12.36, BALY stock is the lagged, as this Hold-rated stock offers investors 3% upside potential.