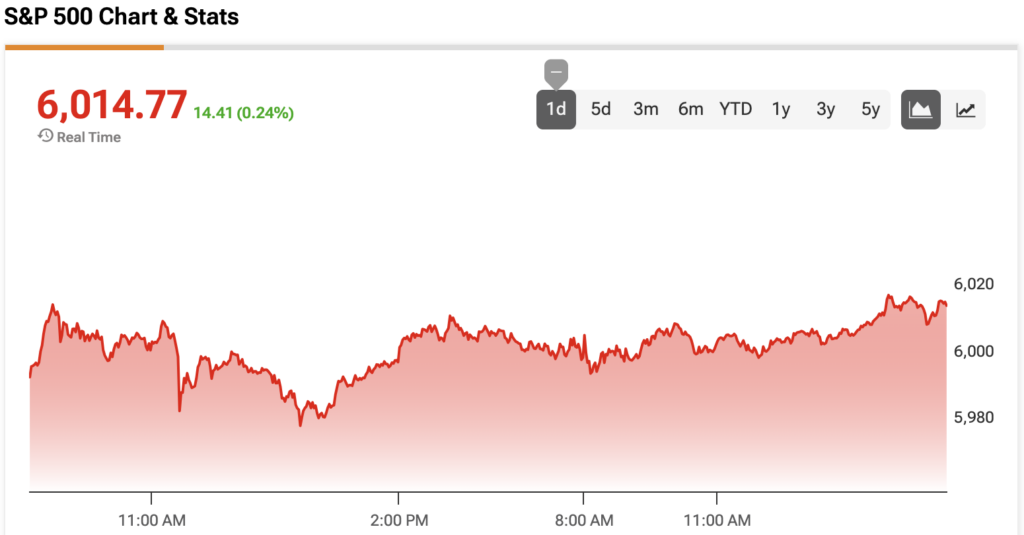

The S&P 500 (SPX) is in the green amid ongoing trade discussions between the U.S. and China that began this morning. The benchmark index is now less than 2.5% away from its all-time high of $6,147.43.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Following President Trump’s tariffs, China’s exports to the U.S. fell by 34.5% year-over-year in May, marking the steepest drop since February 2020. At the same time, the country’s June exports to the U.S. could recover given the preliminary U.S.-China trade deal that took effect on May 14.

In addition, the U.S. could scrap export controls on certain products, such as semiconductor design software, aircraft parts, and ethane, as part of a bargaining chip in its talks with China, reported the Wall Street Journal.

Meanwhile, the New York Fed’s Survey of Consumer Expectations shows that sentiment is steadily improving. The one-year inflation expectation is now at 3.2%, marking a significant drop from 3.6% in April. Furthermore, the median one-year-ahead corporate earnings growth expectation increased by 0.2% month-over-month to 2.7%.

The S&P 500 is up by 0.24% at the time of writing.

Which Stocks are Moving the S&P 500?

Let’s turn to TipRanks’ S&P 500 Heatmap, which illustrates the stocks that have contributed to the index’s performance.

Apple (AAPL) is currently holding its anticipated WWDC 2025 event, although its stock hasn’t responded well to the developments, which include liquid glass and improvements to iMessage. Other Magnificent 7 members, like Amazon (AMZN) and Google (GOOG) (GOOGL), are in the green.

Chip stocks are continuing to chip higher, with Nvidia (NVDA), Advanced Micro Devices (AMD), and Micron (MU) in positive territory. The consumer defensive sector, however, isn’t having such a good day.

SPY Stock Moves Higher with the S&P 500

The SPDR S&P 500 ETF (SPY) is an exchange-traded fund designed to track the movement of the S&P 500. As a result, SPY moves in tandem with the SPX.

Wall Street expects further upside for SPY. During the past three months, analysts have issued an average SPY price target of $662.14 for the stocks within the index, implying upside of 10.28% from current prices. The 505 stocks in SPY carry 419 buy ratings, 78 hold ratings, and 8 sell ratings.