The S&P 500 (SPX) has pivoted several times between positive and negative territory on Thursday, although sellers are currently outpacing buyers despite the release of positive U.S.-China trade developments and a falling goods deficit.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

This morning, the U.S. Bureau of Economic Analysis reported that the April goods trade deficit was $61.6 billion, plunging by 55% from a record-high of $140.9 billion in March as the effect of businesses front-running tariffs and increasing imports ceased. Goods imports from China totaled $28.3 billion, the lowest amount since April 2020. A falling deficit has a positive effect on gross domestic product (GDP), as exports are added and imports are subtracted from the GDP calculation.

Afterwards, President Trump posted on Truth Social that his call with Chinese President Xi Jinping ended in a “very positive conclusion for both countries.” He added that the countries will soon hold another round of trade talks and that Xi invited him and First Lady Melania Trump to visit China. “The conversation was focused almost entirely on TRADE. Nothing was discussed concerning Russia/Ukraine, or Iran,” said Trump.

The S&P 500 is down by 0.15% at the time of writing.

Which Stocks are Moving the S&P 500?

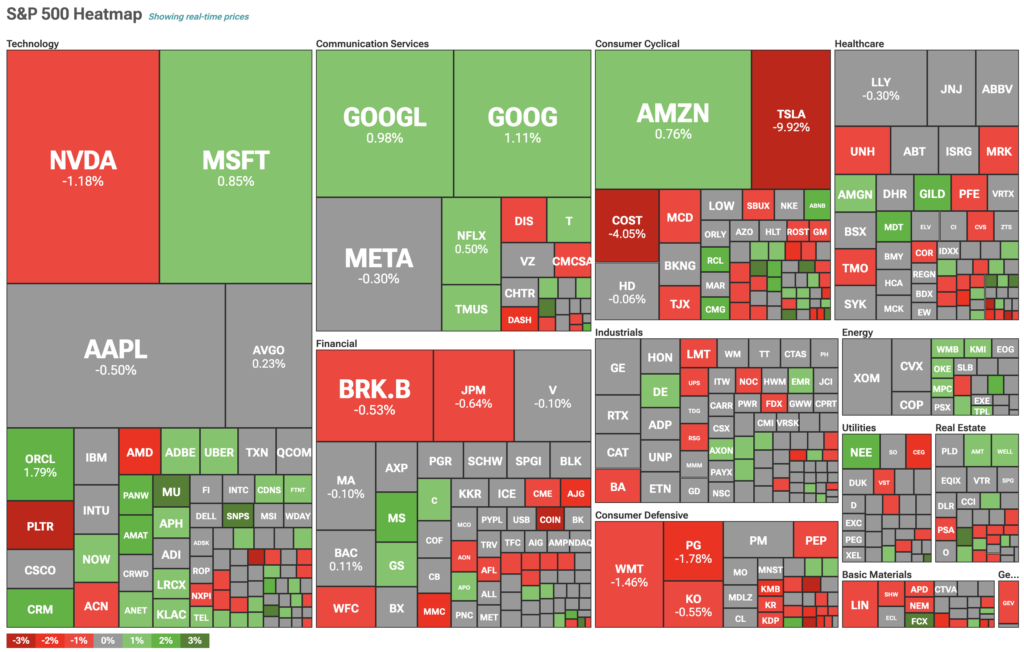

Moving on, let’s turn our attention to TipRank’s S&P 500 Heatmap, which illustrates the stocks that have contributed to the index’s performance.

Tesla (TSLA) is leading the benchmark index lower and is down by nearly 10% as CEO Elon Musk deepens his dispute with Trump. In X posts, Musk said that Trump displayed “ingratitude” towards him and that it wasn’t fair to cut EV and solar incentives in Trump’s bill while leaving oil and gas subsidies in place.

Meanwhile, chip stocks, excluding Nvidia (NVDA), are continuing their march higher, with Micron (MU), Broadcom (AVGO), and Applied Materials (AMAT) trading higher. On the other hand, consumer defensive stocks are having a rough day, led by losses from Procter & Gamble (PG) and Walmart (WMT).

SPY Stock Falls Alongside the S&P 500

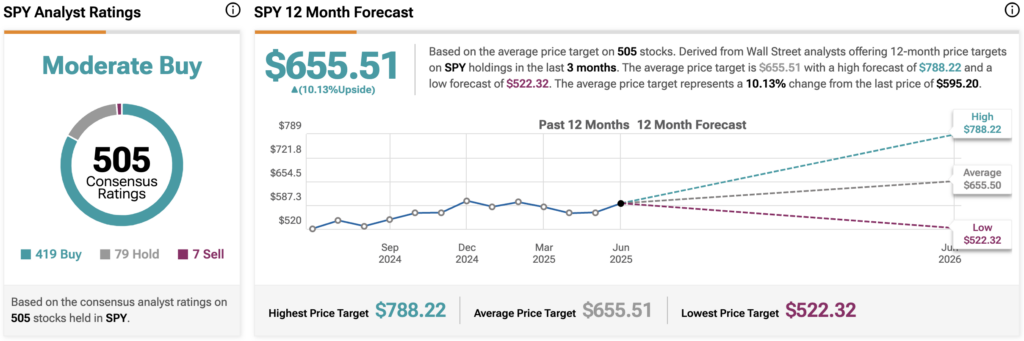

The SPDR S&P 500 ETF (SPY) is an exchange-traded fund designed to track the performance of the S&P 500. Unlike the SPX, SPY can be bought and sold.

Wall Street expects further upside for SPY. During the past three months, analysts have issued an average SPY price target of $655.51 for the stocks within the index, implying upside of 10.13% from current prices. The 505 stocks in SPY carry 419 buy ratings, 79 hold ratings, and 7 sell ratings.