Shares of chipmaker Nvidia (NVDA) sank in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2025. Earnings per share came in at $0.68, which beat analysts’ consensus estimate of $0.65 per share. Interestingly, Nvidia has only missed expectations once since November 2020.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In addition, sales increased by 122% year-over-year, with revenue hitting $30 billion. This beat analysts’ expectations of $28.727 billion and was mainly driven by a 154% jump in Data Center revenue, which came in at $26.3 billion.

Nvidia also announced a $50 billion buyback program, which is a massive amount on an absolute basis but makes up less than 2% of the company’s more than $3 trillion market cap. This comes after Nvidia returned over $15 billion to shareholders during the first half of Fiscal Year 2025 through dividends and buybacks.

Looking forward, management now expects revenue for Q3 2025 to be $32.5 billion (+/- 2%). For reference, analysts were expecting $31.75 billion in revenue.

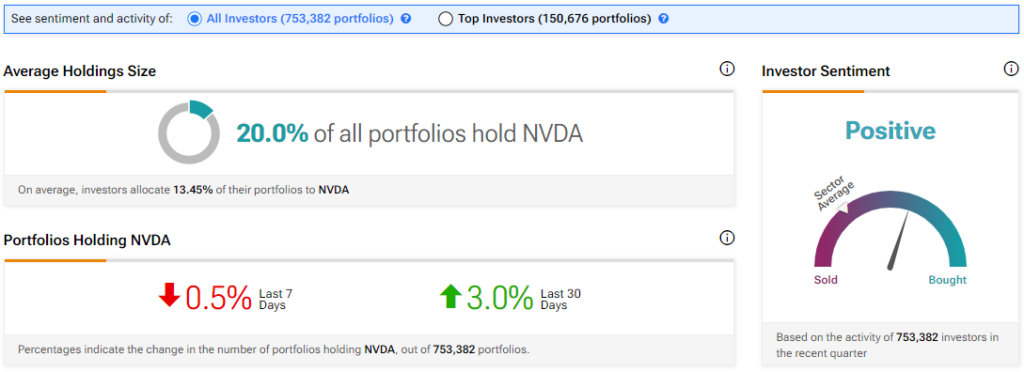

Investor Sentiment for NVDA Stock Is Currently Positive

The sentiment among TipRanks investors is positive. Out of the 753,382 portfolios tracked by TipRanks, 20% hold NVDA stock. In addition, the average portfolio weighting allocated toward NVDA among those who do have a position is 13.45%. This suggests that investors in the company are very confident about its future.

What’s interesting is that this is an increase from the previous earnings report, when 18.8% of investors had a position with an average weighting of 13.21%. This shows that investors grew even more confident in NVDA stock since its Q1 report.

What Is a Good Price for NVDA?

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 33 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 174% rally in its share price over the past year, the average NVDA price target of $149.89 per share implies 16.83% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue