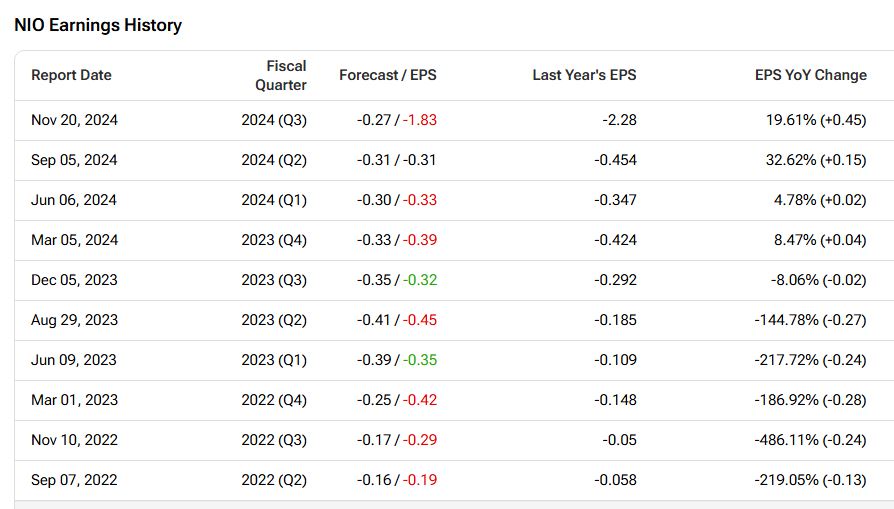

Chinese electric vehicle (EV) manufacturer Nio (NIO) is scheduled to release its third quarter 2024 results on November 20. Wall Street analysts expect the company to report Q3 sales of $2.64 billion, a slight year-over-year increase of about 0.4%. Meanwhile, analysts expect NIO to post a loss of $0.27 per share, lower than the loss of $0.32 in the year-ago quarter, according to TipRanks’ data.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In terms of share price growth, Nio’s stock has dropped by 48.5% year-to-date and 40% over the past year, reflecting challenges in the competitive Chinese EV market. These issues have led to Nio missing estimates in the last few earnings quarters.

Factors to Consider Ahead of Q3 Results

The drop in the share price has occurred despite Nio’s improving delivery profile. In September, the company delivered 21,181 vehicles, up 35.4% year-over-year, marking the fifth consecutive month that Nio surpassed 20,000 unit deliveries. Also, the company delivered 61,855 vehicles in the third quarter, representing an increase of 11.6% year-over-year.

Now, according to TipRanks’ Bulls Say, Bears Say tool, bulls are optimistic about Nio’s future, citing several key factors. The investment from existing shareholders into NIO China is expected to strengthen the company’s cash reserves and ease dilution concerns. Also, Nio holds a strong position, with around 40% of China’s premium EV market. The analysts expect the company’s sales to grow significantly, driven by the Onvo and Firefly brands.

However, bears remain cautious about Nio’s long-term profitability. They argue that the company’s high expenses make it unlikely to reach breakeven in the near future. With rising competition in the EV market, Nio may be forced to reduce its prices, which could further hurt margins.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can gauge what options traders anticipate for Nio stock right after its earnings report. The expected earnings move is calculated by evaluating the at-the-money straddle of options that are set to expire soon after the announcement.

At present, the Options tool indicates that options traders are predicting a 12.21% swing in either direction for Nio stock.

Is NIO a Buy or Sell?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Nio stock based on nine Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. The average Nio price target of $6.33 per share implies 35.55% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue