Shares in sportswear brand Nike (NKE) were off the pace today as German rival Adidas declared it wanted to knock it off the top of the global leaderboard.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Gunning for the Top

However, Nike’s post-results reaction was not as shabby as some had feared. That’s because, despite Adidas’s big game bluster, the German group reported a lackluster forward-looking forecast. Adidas said it expects to see sales growth this year of 10%, down from the 12% reported in 2024. It also expects operating profit of up to $2 billion. That’s up from the $1.4 billion it recorded in 2024 but again down on analyst expectations of nearly $2.3 billion.

Still, Adidas asserted that it had the “clear ambition of being number one” in all markets except North America.

Nike On a New Course

That’s a direct challenge to global leader Nike, which has a market value of $114 billion and revenues of $51 billion. But, according to figures from GlobalData, Nike’s share of the global sportswear market slid to 14.1% last year from 15.2% in 2023. Adidas’s share climbed to 8.9% from 8.2%.

Nike has stumbled in recent years, hit by a less-than-effective direct-to-consumer strategy and a lack of innovation as well as the wider consumer climate. Its stock has raced backwards by around 20% over the last 12 months. But it is up by about 2% in the year to date, helped by new moves such as the launch of a women’s activewear brand in partnership with Kim Kardashian.

Is NKE a Good Stock to Buy Now?

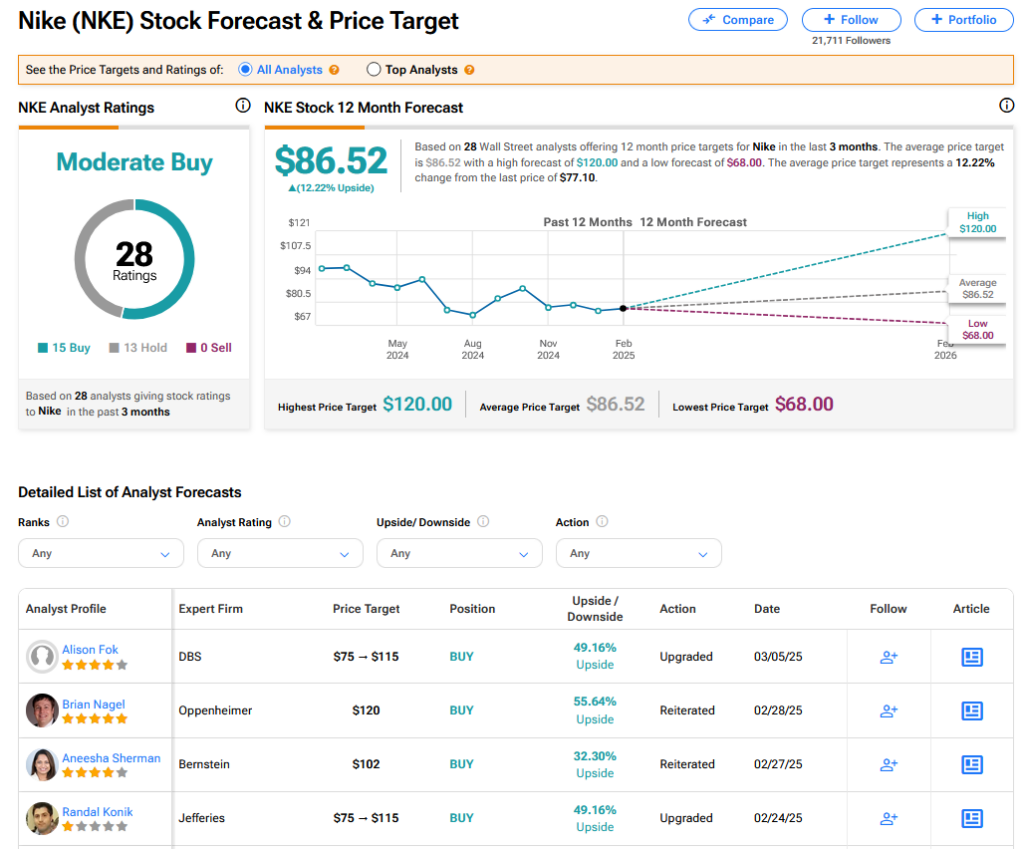

On TipRanks, NKE has a Moderate Buy consensus based on 15 Buy and 13 Hold ratings. Its highest price target is $120. NKE stock’s consensus price target is $86.52 implying an 12.22% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue