Meta’s (META) Orion augmented reality (AR) smart glasses have the potential to revolutionize portable personal computing, but the product faces competition from Google’s (GOOGL) Android XR glasses harnessing its Gemini AI model. Both models should contribute growth to their respective companies, but my valuation models indicate Google is likely to deliver better returns at its present valuation.

Meta’s Orion Glasses Could Be the Company’s “iPhone Moment”

Meta is developing advanced AR smart glasses called Orion, which have the potential to replace the smartphone in portable personal computing. Key features include immersive holographic visuals, AI integration, sensory inputs, and a focus on digital synthesis with interpersonality.

At the moment, Orion reportedly costs around $10,000 to manufacture. However, Meta’s leadership aims to reduce the commercial price point to between $700 and $1,200, aligning with the cost of the current most advanced smartphones.

The primary design element driving high manufacturing costs is the silicon carbide used in the lenses, a rare and expensive material. To mitigate these expenses, Meta has confirmed that the consumer version of Orion will feature glass lenses instead of silicon carbide, though this comes with the downside of a reduced field of view.

This initiative from Meta is formidable and will likely help the company sustain robust growth over the next 10 years with a successful launch and subsequent model iterations. In my valuation model for the company, I project a 12% revenue compound annual growth rate over the next 10 years, a 40% net margin by December 2034, and a -0.16% compound annual decline in its share count, following historical trends.

As a result, my December 2034 price target for Meta stock is $1,705 if it trades at a GAAP price-to-earnings ratio of 22, slightly lower than its five-year average of 25.5. Since the current stock price is $600, the indicated 10-year compound annual growth rate in Meta’s stock price is 11%, leading to my Hold rating.

What Does Wall Street Say About Meta?

On Wall Street, the average META price target is $672.63, suggesting the potential for a 12.14% upside over the next 12 months. This figure is based on 40 Buys, three Holds, and one Sell, with a consensus Strong Buy rating. Even in the near term, returns are only likely to be moderate, supporting my Hold rating.

Google’s Android XR Glasses Are Orion’s Greatest Competition

Google also has a pocket of potential growth, supporting my Hold rating for its stock. While Orion appears to be a groundbreaking model that could advance smart technology, it is not without competition. The strongest competitor I have found is Google’s Android XR software, which is used for both smart glasses and mixed-reality headsets.

For this analysis, I have focused on the Android XR glasses, a direct competitor to Meta’s Orion. Android XR glasses are designed to be more accessible by offloading processing to smartphones, while Meta’s Orion glasses emphasize standalone functionality. In many ways, Android XR glasses will offer lower computing power at a lower cost, while Meta’s Orion is the more expensive and expansive model.

Similarly to Orion, the consumer price for Android XR glasses will likely start at around $1,000 based on headset prices, but could reach $1,500. In my opinion, Android XR glasses will need to undercut the price of Meta’s Orion to remain competitive, much like how Android phones are generally cheaper than iPhones, attracting a less luxury-focused market.

Although Android XR glasses will constitute only a small portion of Google’s overall product and service offerings, if executed properly, they could significantly compound growth in Gemini AI by showcasing it in an easy-to-use consumer product. In my current valuation model for Google, I forecast a 12.5% revenue growth rate over the next 10 years, a 30% net margin in 2034, and a -0.76% compound annual decline in the company’s shares outstanding, based on historical trends.

As a result, my December 2034 price target for Google stock is $635, assuming it trades at a GAAP price-to-earnings ratio slightly below its five-year average of 25.5. My terminal multiple is 22. Since the current stock price is $193, the implied 10-year compound annual growth rate is 12.7%, leading me to issue a Hold rating.

What Does Wall Street Say About Google?

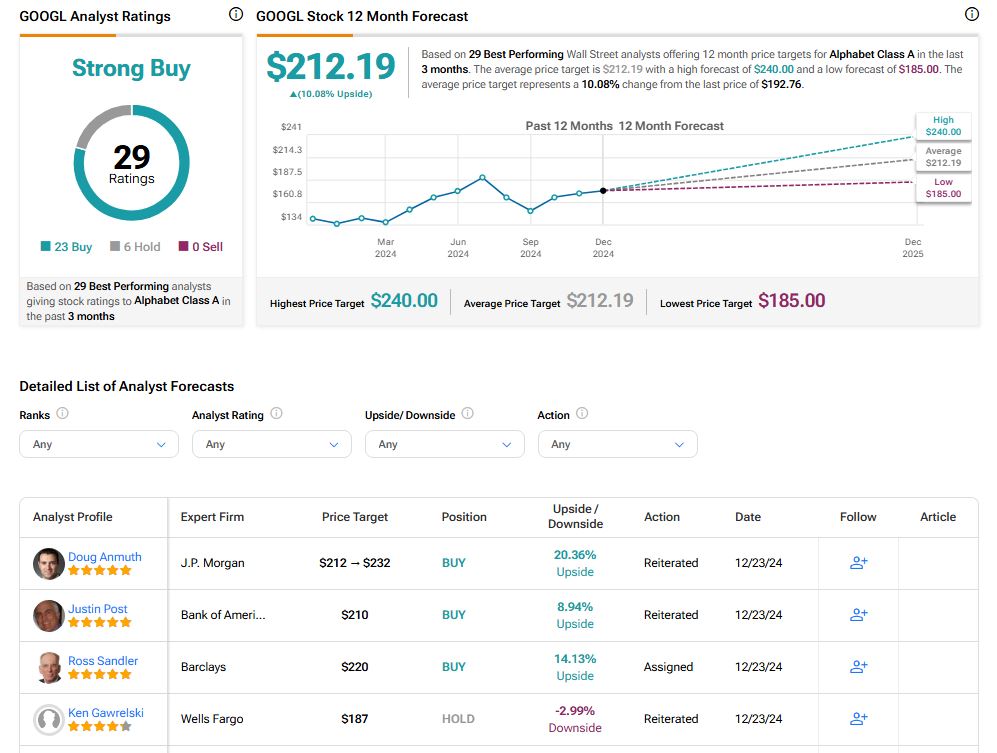

On Wall Street, the average GOOG price target is $212.19, indicating a potential 10.08% upside over the next 12 months. This figure is based on 23 Buys, six Holds, and zero Sells, with a consensus Strong Buy rating. While growth appears stable, returns are likely to be moderate in the near term, reaffirming my Hold rating.

See more GOOGL analyst ratings

Conclusion: Meta Is Better Positioned in AR Glasses than Google

Meta is better positioned for long-term growth due to its more robust AR glasses strategy. However, considering both companies’ likely future growth rates alongside their present valuations, Google appears to offer better long-term stock returns. Nevertheless, because neither company is projected to meet my 15%+ annual return threshold for a Buy rating, my rating for both stocks is a Hold.