Dating app operator Match (MTCH) announced layoffs that will affect 13% of its workforce in its latest earnings report. According to CEO Spencer Rascoff, these job cuts are a “critical first step toward improving user outcomes, which over time drives user growth, revenue expansion, and long-term shareholder value.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Match noted that the cuts will create a more nimble organization with fewer layers that offers a clearer line of sight to execution. The layoffs will affect roughly 325 employees, with management reductions being a major focus. The company is also closing open roles.

Match said the layoffs and reorganization will save it $45 million in 2025. After that, it expects these reductions to increase savings to $100 million annually.

MTCH Stock Movement Today

While Match announced turnaround plans, investors continued to lose confidence in the Tinder owner today. This dropped the stock 1.38% on Friday, extending its 16.18% year-to-date decline. That came alongside heavy trading, as 4.87 million units changed hands, compared to a three-month daily average of 4.58 million shares.

The catalyst behind the drop appears to be the company’s Q1 earnings report. Match is having trouble attracting younger users, as Gen Z shows little interest in its dating apps. While Rascoff expressed dedication to fixing this problem, investors appear unsure that he can.

Is MTCH Stock a Buy, Sell, or Hold?

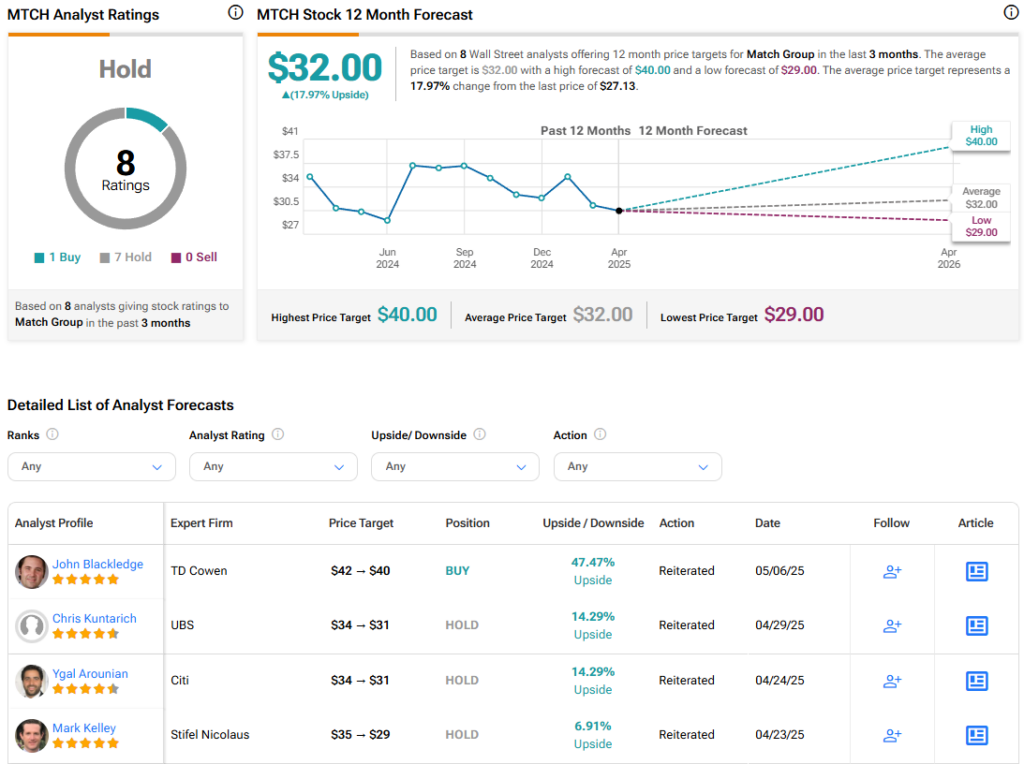

Turning to Wall Street, the analysts’ consensus rating for Match is Hold, based on one Buy and seven Hold ratings over the last three months. With that comes an average MTCH price target of $32, representing a potential 17.97% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after the earnings report.