Lumen Technologies (LUMN) stock plunged over 9% on Tuesday after a Bloomberg report stated that the telecom company is in talks regarding the potential acquisition of its consumer fiber business by larger rival AT&T (T). The report added that the deal could be valued at more than $5.5 billion. However, the talks of a potential deal are in early stages and could ultimately fall apart.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Lumen’s consumer fiber business offers high-speed internet services to residential customers.

Why Lumen Might Offload Its Consumer Fiber Business

The news of a potential sale of Lumen’s consumer fiber business to AT&T comes as the company is doubling down on the artificial intelligence (AI)-led boom for its enterprise customers to offset the lower sales and profits from its legacy business. Lumen has been trying to reduce its dependence on its legacy business that offers broadband, voice, and other services to residential customers and businesses.

To improve its position, Lumen has restructured its debt and signed contracts worth billions of dollars to offer networking and cybersecurity services to Big Tech companies, including Meta Platforms (META), Alphabet (GOOGL), and Amazon.com (AMZN). LUMN stock has rallied more than 173% over the past year, thanks to such significant partnerships.

The Bloomberg report follows a December 2024 report by Reuters, which stated that Lumen had commenced a process to sell its consumer fiber business. It added that Lumen is reportedly working with Goldman Sachs’ (GS) investment bankers to assess the interest for its consumer fiber business from potential buyers, including industry rivals. Further, the Reuters report mentioned that Lumen could consider selling a stake in the consumer fiber operations or enter into a joint venture with a strategic partner.

Coming to AT&T, the deal could be a part of the telecom giant’s strategy to invest in its high-speed fiber internet offerings to boost subscriber and revenue growth.

Wall Street’s Ratings on LUMN and AT&T Stocks

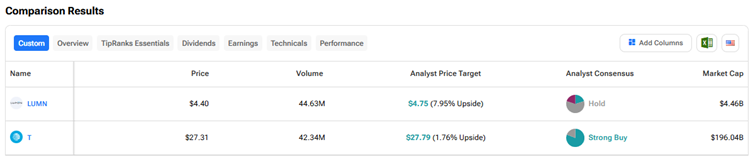

Wall Street is highly bullish on AT&T stock with a Strong Buy consensus rating. However, analysts are sidelined on LUMN stock, with a Hold consensus rating based on one Buy, three Holds, and one Sell recommendation. The average LUMN stock price target of $4.75 implies an 8% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue