Canadian grocery giant Loblaw (TSE:L) recently posted its earnings report, and the numbers proved a bit disappointing. However, there were some clear signs of life ahead, and Loblaw investors were not completely displeased. Shares were down modestly in Thursday morning’s trading as a result.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Loblaw noted that its earnings per share figure came in at $1.52 per diluted share. Adjusted earnings, meanwhile, got a significantly nicer bump, going to $2.20 per diluted share, which was up from $2 even in the fourth quarter of 2023. Meanwhile, revenue gained nicely, coming in at $14.9 billion, which measured well against the $14.5 billion seen a year prior.

Loblaw found itself giving thanks for the timing of Thanksgiving; without Thanksgiving’s impact, same-store food sales would have been up just 1.5%. Thanks to Thanksgiving, meanwhile, food retail same-store sales were up 2.5% instead.

One Big Problem

However, all was not well with Loblaw’s earnings. The biggest cause of loss for its profits was a “non-cash charge” that was connected to the PC Optimum loyalty program, reports noted. The problem was that customers were taking increasing advantage of the program, which meant more discounts, higher redemption rates, and, of course, less profit.

Loblaw may have a larger plan afoot to make up the difference on sheer volume. Reports noted that Loblaw plans to open several more grocery stores in Canada, including not only Loblaw locations, but also No Frills and Maxi locations. That in turn should open up the floodgates for “more affordable food” in Canada. Loblaw looks to put $2.2 billion into investment, and should bring 8,000 new jobs to the market as a result.

Is Loblaw a Good Stock to Buy?

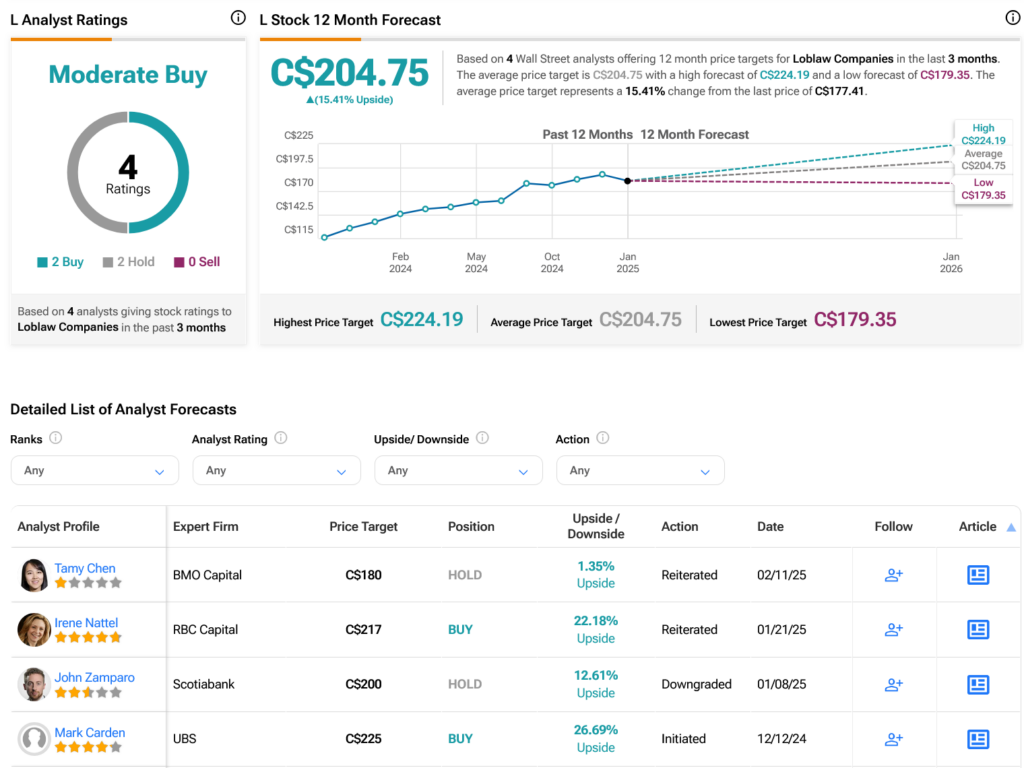

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:L stock based on two Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 29.94% rally in its share price over the past year, the average TSE:L price target of C$204.75 per share implies 15.41% upside potential.

See more TSE:L analyst ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue