Here’s a math question for you: Under what circumstances does $1,200, divided by 10, equal not $120, but $140 instead?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Answer: When the $1,200 refers to a price target on Nvidia (NASDAQ:NVDA) stock before its stock splits 10-for-1, and the $140 refers to how much one analyst thinks the stock is worth after the split.

In a recent research note, TD Cowen’s Matt Ramsay, a 5-star analyst rated in the top 1% of the Street’s stock pros, explained his decision to pre-emptively raise his price target on Nvidia, by $20 per 10-for-1-split-share. Nvidia was the analyst’s “best idea” on the stock market before the split, and according to Ramsay, this remains true post-split as well.

In fact, rather than spend a lot of time expounding on new theories for why investors should invest in the leading producer of semiconductor chips tailored to AI applications, Ramsay defaulted to just “tweaking” his models for what he thinks the company can earn, and what he thinks the stock is worth, now that each individual share is priced 10x cheaper than it used to be.

Examples? Well consider software, a relatively small part of Nvidia’s business, yet one that the company says will hit $1 billion in annual sales at the end of its fiscal 2024. Prior to the split, Ramsay estimated that software will probably help Nvidia to reach a goal of about $60 in total annual earnings by 2030 – but might actually reach that mark as early as 2026, and could conceivably be earning as much as $150 a share by 2030. Now that the split has happened, Ramsay has tweaked his model to estimate $6 in probably earnings by 2030, $6 potentially by 2026, and $15 potentially by 2030.

As the analyst deadpanned, this just proves that at TD Cowen, the analysts “can divide by ten.”

That’s arguably the least interesting thing that Ramsay said in his note, however. If you ask me, the most important thing found in this note goes as follows: Currently, Nvidia stock costs a bit more than $120 a share already. So had Ramsay not raised his price target, he’d effectively have had to say he thought Nvidia stock would be dead money for the next year. Instead, he’s predicting something closer to a 16% profit over the next 12 months (and recommending that investors buy the shares).

With Nvidia stock priced north of 70 times its $1.70 per share in trailing earnings, you might think the stock is a bit expensive to be recommending that investors keep buying it, but consider: If Ramsay is right, then over the next six years Nvidia is going to grow its earnings by at least another two-and-a-half times (and might grow earnings closer to seven times). Effectively, what he’s saying then is that, while Nvidia stock looks expensive today, it is going to grow into its value over time, by exhibiting “strong, sustained, above-peer [earnings] growth across a widening set of verticals” over the next six years.

Anyone paying 70-plus times earnings for Nvidia stock today had better hope he is right about that. (To watch Ramsay’s track record, click here)

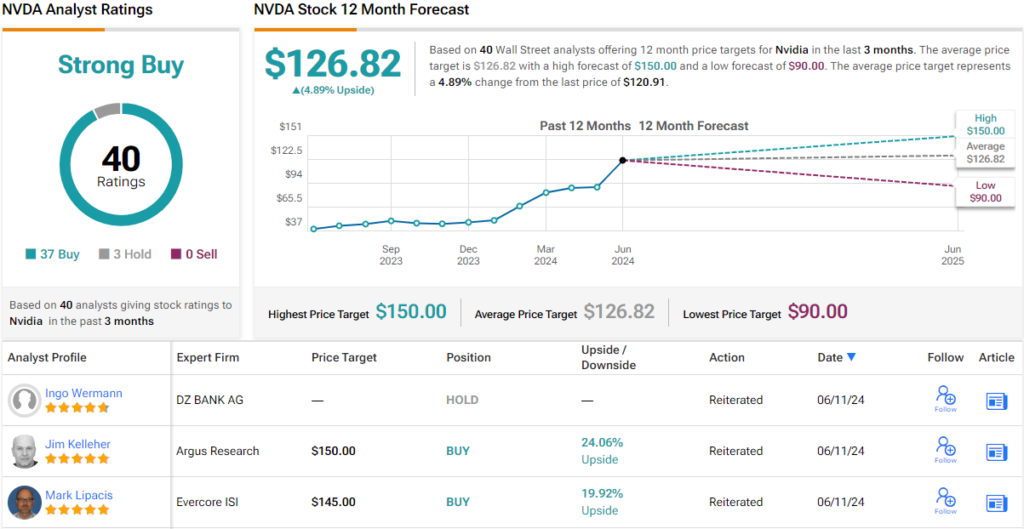

Overall, Nvidia has most of Wall Street’s analyst corps on its side. Out of 40 recent reviews, 3 recommend to Hold, while all the rest say Buy, naturally culminating in a Strong Buy consensus rating. However, in the year ahead, the shares are anticipated to add a modest 5%, considering the average price target stands at $126.82. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.