Li Auto (NASDAQ:LI) gained in pre-market trading on Monday after the company announced on Weibo, that cumulative orders for the Li L6 exceeded 41,000 units between April 18 and May 5. The Chinese automaker’s L6 was launched last month and is a premium five-seater Sports Utility Vehicle (SUV).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Li’s L6 is its first model priced under RMB300,000 and is available in two versions, Pro and Max. After the launch of the L6, the company was offering limited-time benefits, totaling RMB 20,000, to customers who ordered the L6 between April 18 and May 5.

Analysts Are Bullish on Li’s L6 Model

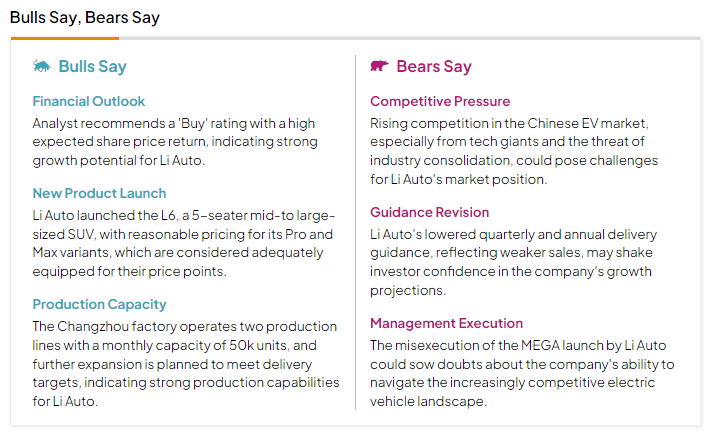

In April, Li Auto’s vehicle deliveries inched up by 0.4% year-over-year to 25,787 vehicles. According to the TipRanks investment research tool, “Bulls Say, Bears Say,” which provides stock analysis insights for investors, analysts bullish on Li approve of the L6 and its “reasonable pricing.” In contrast, analysts bearish on LI argue that competitive pressures in China could threaten Li’s market position.

Is LI a Good Stock to Buy?

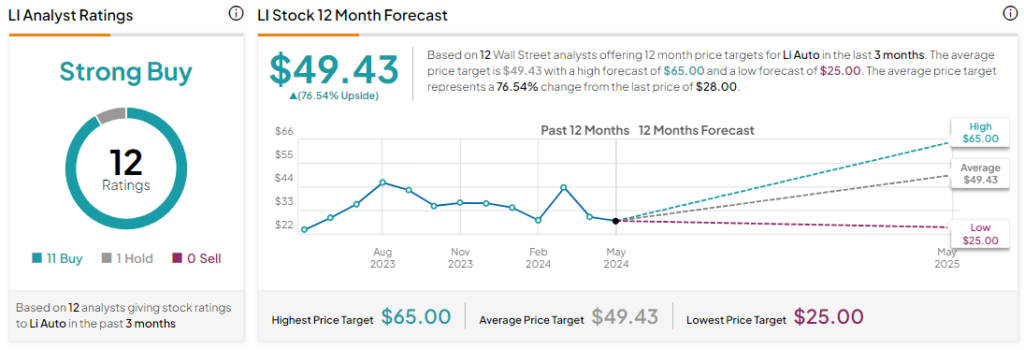

Analysts remain bullish about LI stock, with a Strong Buy consensus rating based on 11 Buys and one Hold. Year-to-date, LI has declined by more than 20%, and the average LI price target of $49.43 implies an upside potential of 76.5% from current levels.