Netflix (NFLX) stock has advanced 9% year to date and has rallied 55% in the past year, thanks to its solid financials and growing subscriber base. On Monday, JPMorgan analyst Doug Anmuth reiterated a Buy rating on NFLX stock with a price target of $1,150, reinforcing his bullish stance and indicating continued upside potential. Meanwhile, Loop Capital analyst Alan Gould reaffirmed a Hold rating with a price target of $1,000, cautioning about pressure on Q1 2025 engagement.

Analysts Have Mixed Opinions on Netflix Stock

JPMorgan’s Anmuth, a 5-star analyst, noted that Netflix stock has outperformed the S&P 500 Index (SPX) so far in 2025, backed by optimism about the company’s 2025 revenue growth outlook of 12% to 14%, a solid content slate, and it’s strengthening leadership position in the streaming space.

Anmuth expects NFLX to be “relatively defensive” against macro challenges, thanks to its impressive engagement, affordability of its offerings coupled with high entertainment value, and the low-priced advertising tier, which makes the platform more accessible.

Meanwhile, Loop Capital’s Gould noted that while Netflix’s Q1 2025 engagement is trending higher by 5% quarter to date, weekly reports reveal that engagement has been down over the past four weeks. Though the 4-star analyst expects Netflix to be more economically resilient than most companies, he cautioned that some subscribers may shift to the lower-priced ad tier, mainly after the price hike.

While Gould believes that Netflix is “superbly positioned,” he is sidelined on the stock as he thinks that it is fairly valued based on low-teens revenue growth expectations.

Is NFLX Stock a Good Buy?

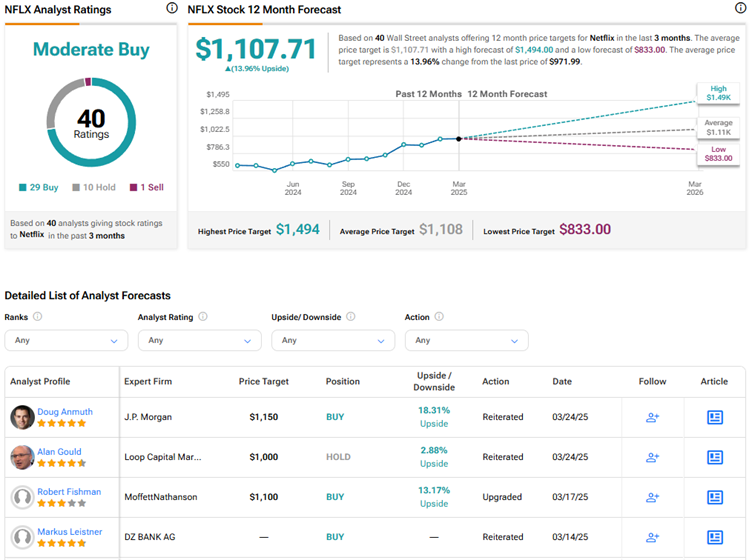

Overall, Wall Street is cautiously optimistic about Netflix stock, with a Moderate Buy consensus rating based on 29 Buys, 10 Holds, and one Sell recommendation. The average NFLX stock price target of $1,107.71 implies about 14% upside potential from current levels.