Johnson & Johnson (JNJ) announced its plans to invest over $55 billion over the next four years in the U.S. to strengthen its manufacturing, R&D, and technology capabilities. Notably, J&J has previously emphasized its strong U.S. manufacturing presence, aligning with Trump’s push for domestic production. If Trump’s proposed April 2 tariffs take effect, U.S.-based production could help drugmakers avoid additional costs.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

More Details on the Investment

The latest investments mark a 25% increase as compared to the previous four years. As part of this investment, the company will begin construction on a new manufacturing facility in Wilson, North Carolina, focused on producing cancer and other medicines.

Additionally, it has committed to building three more facilities at yet-to-be-disclosed locations while expanding existing sites. The investment will also fund research into new medications, robotics, and advanced technology to accelerate drug discovery.

Trump’s Push for U.S. Manufacturing Dominance Gains Momentum

Trump’s push for U.S. manufacturing dominance is gaining momentum as major American companies announce plans to expand domestic production.

Last month, Eli Lilly (LLY) announced plans to invest at least $27 billion in constructing four new manufacturing plants across the U.S.

In the technology sector, AI-driven chipmaker Nvidia (NVDA) recently announced plans to invest billions of dollars in U.S.-based manufacturing over the next four years. The investment adds to Trump’s ambitious Stargate Project, unveiled in January, which seeks to invest $500 billion into U.S. AI infrastructure over the next four years. The initiative, spearheaded by Microsoft (MSFT)-backed OpenAI, Oracle (ORCL), and SoftBank (SFTBY), aims to strengthen America’s position in the global AI race. Meanwhile, Apple (AAPL) has also pledged billions to expand its U.S. operations, further reducing its reliance on China.

Is JNJ a Good Stock to Buy Now?

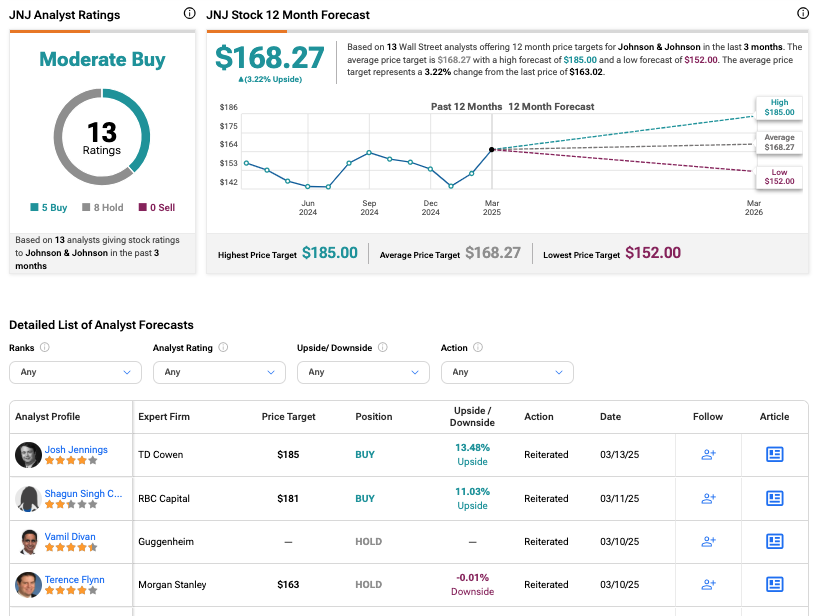

According to TipRanks, JNJ stock has received a Moderate Buy consensus rating, with five Buys and eight Holds assigned in the last three months. The average share price target for JNJ is $168.27, suggesting a potential upside of 3.2% from the current level.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue