IonQ (IONQ) stock has soared 418.5% over the past year. The company is benefiting from its strong position in the quantum computing space. Its advanced trapped-ion technology, which helps solve complex problems more efficiently than classical computers, keeps investors optimistic about its prospects. Further, IonQ is actively expanding its footprint, with key partnerships and acquisitions. Despite massive gains, technical indicators suggest that IonQ stock is a Buy, implying further upside from current levels.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Analyzing IONQ’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, IONQ stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 32.66, while its price is $40.34, implying a bullish signal. Further, its shorter duration EMA (20 days) also signals an uptrend.

Another technical indicator, Williams %R, helps traders determine if a stock is overbought or oversold. In the case of IONQ, Williams %R currently indicates a Buy signal, suggesting that the stock is not overbought and has more room to run.

Moreover, the Rate of Change (ROC) is a momentum-based technical indicator. It measures the percentage change in a stock’s price between the current price and the price from a specific number of periods ago. Typically, a ROC above zero confirms an uptrend. Coca-Cola stock currently has an ROC of 29.10, which signals a Buy.

Is IonQ a Good Buy?

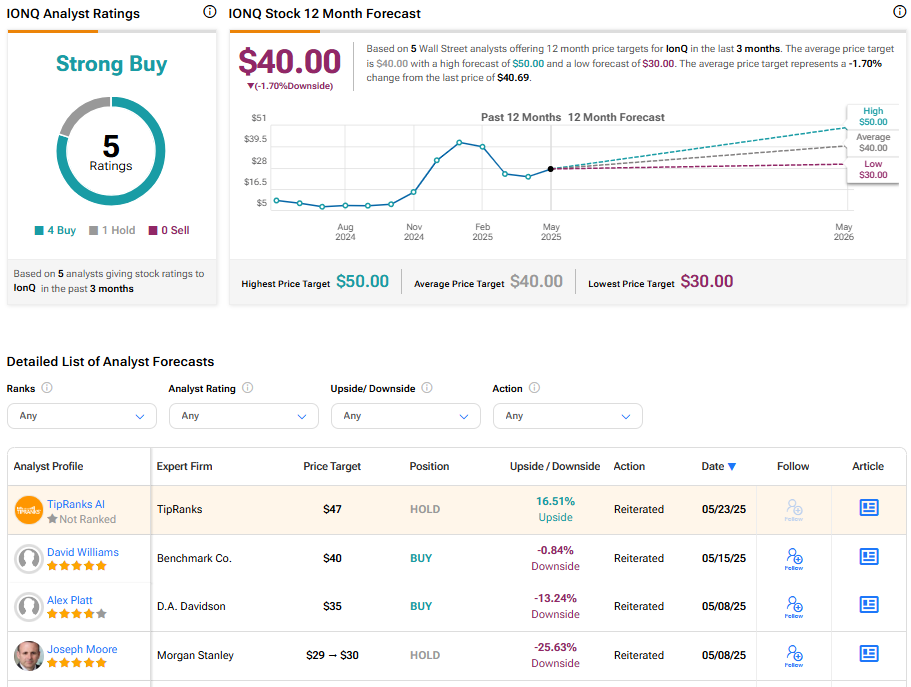

Turning to Wall Street, IONQ has a Strong Buy consensus rating based on four Buys and one Hold assigned in the last three months. At $40, the average IonQ price target implies 0.84% downside potential.