The Federal Reserve’s March Federal Open Market Committee (FOMC) is done and with it comes a decision on interest rate cuts. The central bank has decided to hold off on an interest rate cut this meeting, matching experts’ expectations.

As for the rest of 2025, more interest rate cuts could be on the way. The majority of FOMC officials expect two interest rate cuts in 2025. There’s also a minority that believes the Fed will only introduce one rate cut this year. An even smaller minority remains the most bullish, with expectations for three interest rate cuts in 2025.

The decision to hold off on interest rate cuts means the Fed still believes inflation is at risk of increasing. That tracks, as inflation has remained stuck above the 2% rate the central bank wants it down to. Reducing interest rates before inflation lowers could cause it to start spiking again.

What About the Economy?

The Federal Reserve lowered its estimate for 2025 economic growth from 2.1% to 1.7%. This tracks with other expert opinions, which predict U.S. economic growth will slow and inflation will increase over the next year. That comes alongside an ongoing trade war between the U.S., Canada, Mexico, China, and Europe. This trade war could continue, with additional tariffs affecting the economy.

How Does This Affect the Stock Market?

The major indices are up as of this writing, signaling that investors are pleased with the latest Fed decision. It bears noting that a hold on interest rate cuts was expected by the market. The majority of Fed officials expecting two rate cuts this year is likely boosting investor morale today.

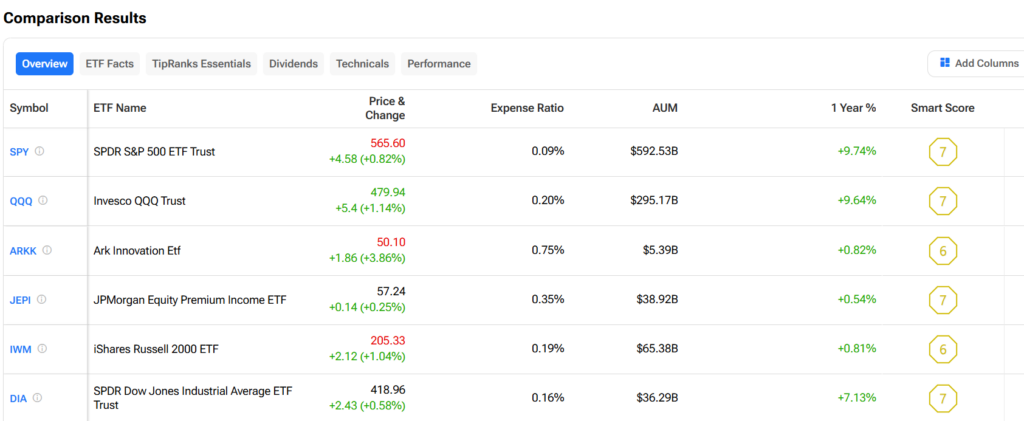

Investors might consider taking stakes in exchange-traded funds (ETFs) alongside the latest Fed decision. This gives them a wide net over the stock market. They can also purchase shares of ETFs that track the S&P 500 (SPX), the Dow Jones Industrial Average (DJIA), and the Nasdaq 100 (NDX).

See more stock market ETF comparisons

Questions or Comments about the article? Write to editor@tipranks.com