Abdiel Capital Advisors, LP, a more than 10% owner of Appian Corp. (APPN) continues to amass shares of the software technology company. Appian provides business process management solutions that automate and enhance productivity.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Abdiel Capital is an investment management firm that makes long-term, value investments in companies having a recurring revenue business model. Accordingly, Abdiel has been consistently building its stake in Appian, making it one of the top three holdings of the investment firm.

A Closer Look at the Insider’s Transactions

As per the Form 4 filing with the SEC, Abdiel Capital made multiple purchases of APPN shares between July 19 and July 23. In all, Abdiel purchased 190,000 Appian shares at average prices ranging from $34.69 to $36.03 per share.

It is worth noting that following the latest Informative buy trade, Abdiel Capital now owns APPN shares worth roughly $536.79 million. This is the insider’s fourth major share purchase in July alone, implying confidence in Appian’s business potential.

Appian stock currently has a Positive Insider Confidence Signal on TipRanks based on $54.7 million worth of Informative Buy transactions undertaken in the last three months.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Appian a Good Stock to Buy Now?

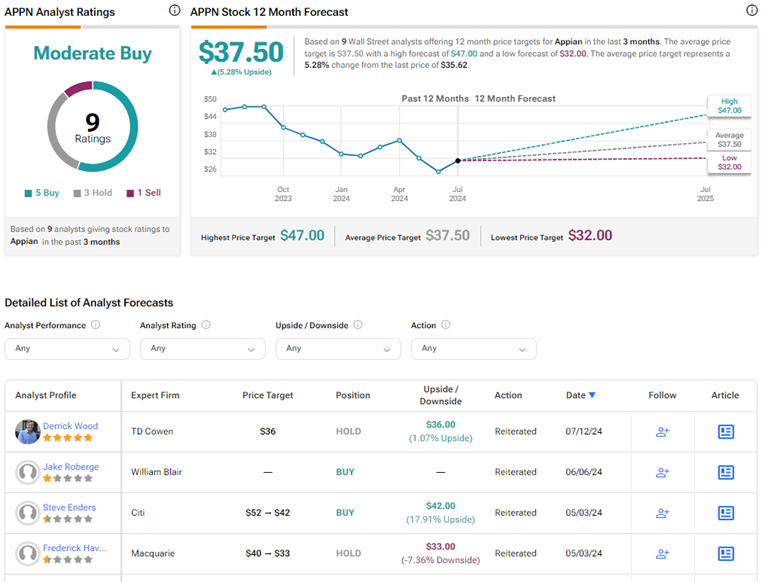

On TipRanks, APPN stock has a Moderate Buy consensus rating based on five Buys, three Holds, and one Sell rating. The average Appian price target of $37.50 implies 5.3% upside potential from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue