Quantum computing stocks have been volatile as investors try to figure out if the technology’s promise justifies the hype. According to five-star analyst Vivek Arya during a Yahoo Finance interview, a good sign of an industry’s importance is whether or not Taiwan Semiconductor (TSM) is manufacturing chips for it—and so far, it is not. Interestingly, Google (GOOGL) helped create the initial excitement for quantum computing when it revealed its new quantum chip last December.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Nevertheless, the analyst emphasized that while quantum computing is a high-growth area, it’s still tiny compared to the overall semiconductor industry. In addition, public comments from big tech names have added pressure to the sector. Nvidia (NVDA) CEO Jensen Huang suggested that practical quantum computing is still 15 to 30 years away, while Meta (META) CEO Mark Zuckerberg said it’s at least a decade out. As a result, stocks like Rigetti Computing (RGTI) and D-Wave Quantum (QBTS) have seen sharp ups and downs since the initial excitement.

Still, not everyone is convinced that the technology is that far off. In fact, Microsoft (MSFT) co-founder Bill Gates recently told Yahoo Finance that a breakthrough could happen within three to five years. Even so, the sharp pullbacks in Rigetti and D-Wave after big run-ups last year show just how speculative the industry remains. With total industry revenue of around $2 billion, quantum computing is still in its infancy, and many of the companies involved still have not proved that they can generate sustainable sales or profits.

Which Quantum Computing Stock Is the Better Buy?

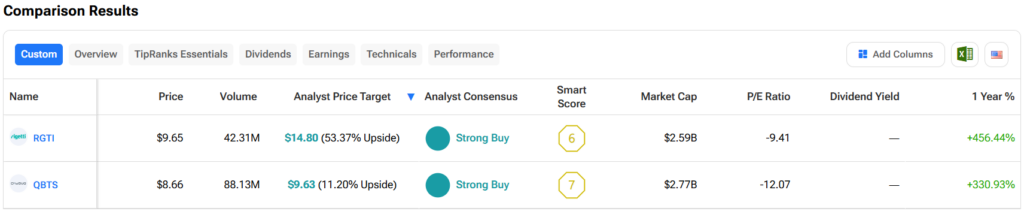

Turning to Wall Street, out of the two quantum computing stocks mentioned above, analysts think that RGTI stock has more room to run than QBTS. In fact, RGTI’s price target of $14.80 per share implies more than 53% upside versus QBTS’ 11.2%.