Currently, NIO (NYSE:NIO) stock is trading near $4 per share, but is this the bottom? It’s been a remarkable fall having once traded about 15x higher. While investors may be enticed by the price tag, trying to catch a falling knife can be dangerous. What’s more, the company has perenially underdelivered after having shown so much promise during the pandemic with its novel battery-swapping technology. So, with EV demand weakening, I’m wondering if NIO has missed its chance. I’m neutral on NIO stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Is NIO Stock the Biggest Loser?

NIO has differentiated itself from its peer group, but not entirely in a good way. NIO is perhaps the biggest loser of the Chinese EV race, with the company promising so much with its novel technology and premium offering. There are several reasons for this, and the chronology of these events has probably worsened issues.

NIO was negatively impacted by the pandemic, more so than its peers. China’s extended lockdowns caused significant disruptions to supply chains worldwide, including the auto industry. This impacted NIO’s ability to produce vehicles at its desired capacity, and investor confidence never really recovered.

However, even in a post-pandemic world, the company has failed to deliver the growth many investors had expected. Some analysts have attributed this to range anxiety — concerns about how far an EV will get you before you need to charge up — and others to the more premium nature of its pricing. But it’s equally the case that NIO just hasn’t produced as many vehicles as expected.

This is evidenced by the recently released quarterly figures. NIO delivered 30,053 vehicles in the first quarter of 2024, marking a fall from 31,041 vehicles in the first quarter of 2023. Moving forward, things aren’t expected to improve in the near term as the sector goes through a rough patch. Demand for EVs has fallen, while Tesla (NASDAQ:TSLA) appears likely to continue with its aggressive pricing strategy, given the number of unsold vehicles at the end of Q1.

Is NIO Stock Worth the Price Tag?

NIO might be trading at a fraction of its highs, but questions still remain as to whether this loss-making EV manufacturer deserves its $8.4 billion market cap. I’ve previously been bullish on NIO, but the sector has changed significantly since then.

One of the biggest developments is the advancements in charging speeds. Li Auto’s (NASDAQ:LI) first battery electric vehicle, the Mega, can be fully charged — with 500km of range — in just 12 minutes. I see this as groundbreaking, and it makes me wonder whether NIO’s battery-swapping technology will become somewhat redundant or obsolete.

After all, NIO’s battery-swapping technology was its key differentiator from the sector, and the technology allows drivers to simply pull up at a battery-swapping station and change their empty batteries for fully charged ones in a matter of minutes. But with charging times falling steeply, I’m not sure battery swapping is the unique selling proposition it used to be.

This also means that NIO has had to build its own network of battery-swapping stations. At the end of Q3, NIO had a global charging network of 1,923 Power Charger Stations. NIO plans to add 1,000 battery swap stations and 20,000 charging piles in 2024 in China — bringing the total to around 3,310 — and each battery-swapping station costs around $420,000 to construct. While battery-swapping stations will be revenue-generating, developing this infrastructure is a sizeable cost many of its peers don’t have.

Finally, NIO isn’t profit-making; it isn’t forecasted to register a profit until 2027. It’s currently trading at 16.7x expected earnings for 2027. However, we still have three years of loss-making before profitability is reached. Personally, I find it a little risky to invest in a company when profitability is so far away. Forecasts tend to become less reliable the further we look into the future. Nonetheless, it’s worth noting that at 0.8x EV-to-sales, NIO looks a little cheaper than its peers.

Is NIO Stock a Buy, According to Analysts?

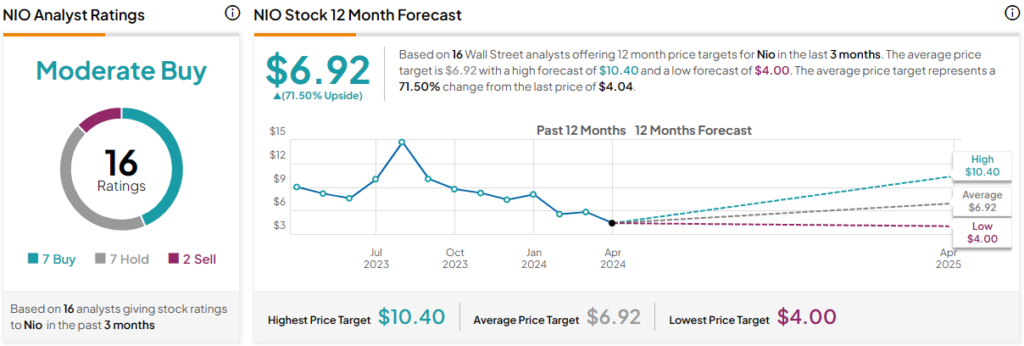

NIO stock is rated Moderate Buy based on seven Buys, seven Holds, and two Sells assigned in the past three months. NIO stock has seven Buy ratings, seven Hold ratings, and two Sell ratings. The average NIO stock price target is $6.92, with a high forecast of $10.40 and a low forecast of $4.00. The average price target represents a 71.5% change from the last price of $4.04.

The Bottom Line on NIO Stock

NIO looks like a speculative investment, in my view. While analysts forecast that profitability will eventually be reached, a lot can happen between now and 2027. Moreover, the EV sector is going through a rough patch, and as such, it’s unlikely that the company’s performance will improve anytime soon.

I’m also concerned about NIO’s unique selling proposition—its battery-swapping technology. This seemed like a great idea two years ago. However, advancements in charging technology could make battery swapping obsolete.

There are a lot of reasons I wouldn’t invest in NIO, but I also accept it’s operating in an industry that will likely experience long-term tailwinds. It’s also a little cheaper than its peers on sales metrics. These factors lead me to be neutral on the stock overall.