The stock of Groupon (GRPN) is up 15% after the e-commerce company reported fourth-quarter 2024 financial results that beat Wall Street’s forecasts and provided an optimistic outlook for the year ahead.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Chicago-based Groupon posted an earnings per share (EPS) loss of -$1.20 and revenue of $130.4 million for the final quarter of last year, which was only slightly better than consensus estimates. However, Groupon reported that its North American business, which accounts for 70% of revenue, saw billings grow 8% year-over-year driven by a 3% increase in higher average order values.

Additionally, Groupon reported that its international segment returned to growth during the quarter, with a 2% increase in foreign billings. “We successfully executed several complex technical migrations, stabilized our platform, and most importantly, reignited growth in key parts of our business,” said CEO Kedar Deshpande in the company’s earnings release.

Forward Guidance

For all of this year, Groupon said that it expects billings to grow between 2% and 4% compared with 2024, and for revenue to be flat to up 2% year-over-year. The company also forecasts adjusted earnings of $70 million to $75 million.

Groupon ended last year with $229 million of cash on hand. The stock’s big after hours move suggests investors are encouraged by the company’s progress in its transformation efforts and positive outlook for the coming year. The company operates a global e-commerce marketplace that connects subscribers with local merchants by offering activities, travel, goods and services.

GRPN stock has declined 47% over the past year.

Is GRPN Stock a Buy?

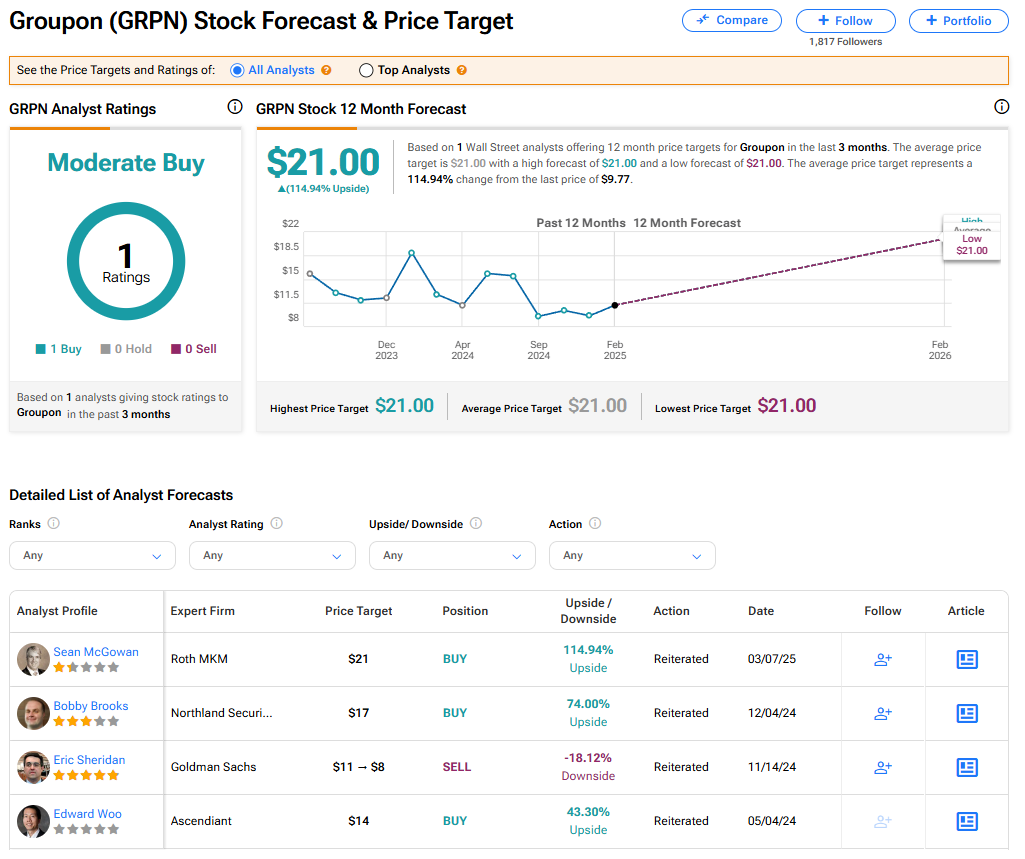

The stock of Groupon has a consensus Moderate Buy rating based on one Wall Street analyst, who has a Buy recommendation on the shares. The GRPN price target of $21 implies 115% upside from current levels. This rating might change following the company’s latest financial results.

Read more analyst ratings on GRPN stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue