Tesla (NASDAQ:TSLA) has always been viewed by some as more than a car company with EVs just acting as the jumping point for other endeavors.

Morgan Stanley analyst Adam Jonas, for instance, has built his investment thesis on a belief that Tesla is at the forefront of physical AI. He points to the company’s growing expertise across key domains –autonomous driving, humanoid robotics, energy storage, high-performance compute, advanced manufacturing, and even space, communications, and infrastructure. According to Jonas, these capabilities unlock “growth and margin opportunities that greatly exceed those of the traditional EV business,” which he notes is currently under mounting pressure.

“Put another way,” Jonas goes on to add, “we believe the challenges facing Tesla’s current business are widely reported and well known, while the opportunities in the future business are potentially greatly underestimated.”

These comments represent Jonas’ summary to some “musings” on Tesla’s current situation. While the analyst thinks there will be numerous opportunities Tesla will be able to take advantage of in the future, the company faces several challenges right now.

One of those appears to be Xiaomi’s first car, the SU7, which “continues to win the hearts of consumers and the minds of auto company CEOs and Board members around the world.” When recently asked about the SU7, Ford CEO Jim Farley responded that it’s “management’s responsibility to beat the SU7 straight up in a street fight.”

Given the current geopolitical climate, Jonas says investors think it is “unfathomable” that Chinese automakers could gain significant traction in the U.S. market. However, conversations with global auto industry executives suggest that Chinese EVs will eventually reach American consumers – by being manufactured locally, of course. As one executive put it, “You can’t expect to keep the world’s best EVs from the best consumer.”

“From the lens of this autos analyst,” Jonas said on the matter, “while it will take some time and complex negotiating, I expect to see a number of strategic maneuvers that will ultimately lead to China EVs made in US factories.”

Meanwhile, Elon Musk recently pledged to double U.S. auto production over the next two years while stating that the Tesla Cybercab will lack a steering wheel, saying it will “either self-drive or not drive at all.” However, Jonas thinks that plenty of investors seem uneasy with Tesla’s ‘all or nothing’ stance on autonomy.

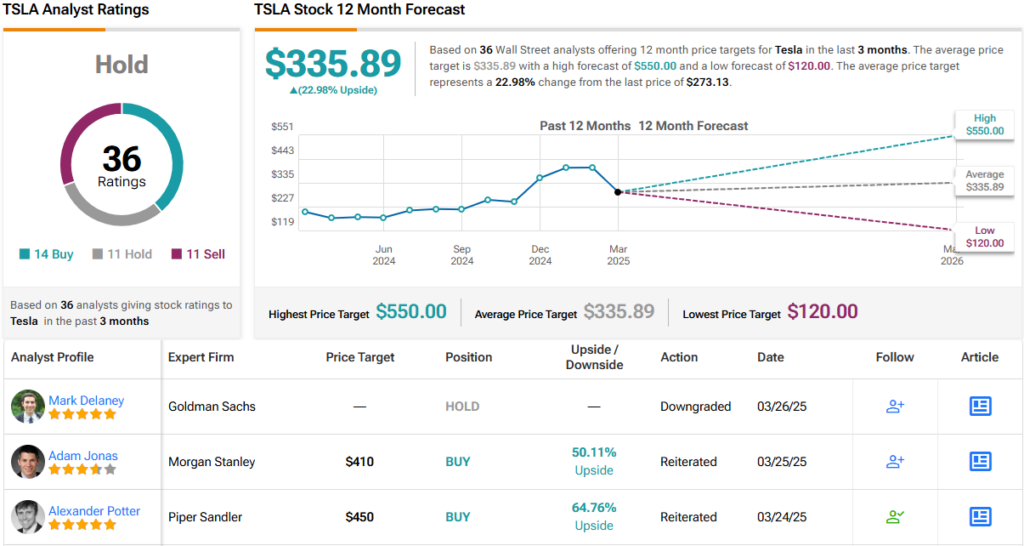

That does not seem to bother Jonas, however, who assigns Tesla shares an Overweight (i.e., Buy) rating, along with a $410 price target. If met, the figure could yield returns of 50% over the one-year timeframe. (To watch Jonas’ track record, click here)

13 other analysts join Jonas in the bull camp but with an additional 11 Holds and Sells, each, the analyst consensus rates the stock a Hold (i.e., Neutral). Going by the $335.89 average price target, shares will appreciate by ~23% over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.