DAX 40-listed Volkswagen AG (DE:VOW) announced a 22.6% jump in its total group deliveries for November, leading to 824,300 vehicles. This growth was attributed to robust demand in North America and China, with a 47.2% and 32.4% increase in sales, respectively. Additionally, sales rose by 16.7% in Central and Eastern Europe and 14.8% in Western Europe.

Year-to-date, the stock has dropped by almost 20%, mainly due to margin pressures and profit warnings for the full year. However, analysts remain bullish on the long-term prospects, citing strong delivery numbers as a sign of significant demand and confidence in the company’s vehicles.

Volkswagen (VW) is a well-known luxury car manufacturer, owning brands like Volkswagen, Skoda, Audi, Bentley, Ducati, and Lamborghini.

Robust Sales Volumes but Dismal Profits

In the first nine months of FY23, Volkswagen Group experienced robust growth in both deliveries and sales revenue. The total deliveries surged by 11% on a year-over-year basis to 6.7 million vehicles during the first three quarters. Concurrently, sales revenue saw a notable 16% increase, totaling €235.1 billion.

Volkswagen’s electrification strategy is advancing, as evidenced by a 45% increase in deliveries of battery electric vehicles (BEV) in the first nine months. The BEV’s share of total deliveries has expanded to 7.9% during this period.

On the flip side, the company’s operating profit decreased by 7% to €16.2 billion in the nine-month period. The company reduced its return on sales outlook to the range of 7.0% to 7.3%, compared to the previously forecasted range of 7.5% to 8.5% due to adverse impacts of hedging on raw materials.

For the full year, the company maintained its forecast for customer deliveries in the range of 9 and 9.5 million vehicles. Additionally, Volkswagen anticipates its sales revenue will remain 10% to 15% higher than the previous year’s figure.

Is Volkswagen a Good Stock to Buy Now?

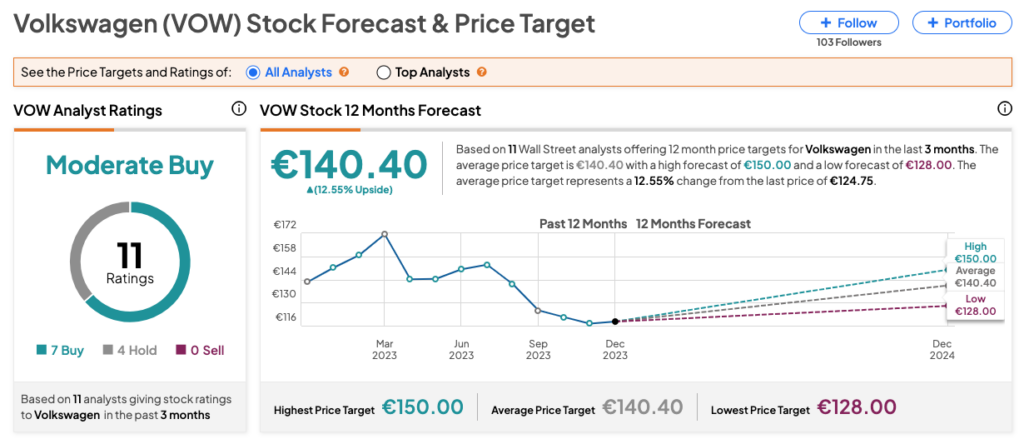

According to TipRanks’ consensus, VOW stock has received a Moderate Buy rating based on recommendations from 11 analysts. This includes seven Buy and four Hold recommendations. The Volkswagen share price forecast is €140.4, which is 12.55% higher than the current price level.