French fashion house LVMH Moet Hennessy Louis Vuitton (FR:MC) is exiting the cruise retail space by giving up a majority stake to a group of four expert investors led by Florida property developer Jim Gissy. Nonetheless, the luxury goods powerhouse will hold an “important minority shareholder” status in the business. The news came on Friday, December 8, pushing MC shares up by 3.3%.

A new joint venture, called Global Travel Retail Holdings, will be formed to manage the business.

LVMH boasts several luxury brands, including Louis Vuitton, Tiffany & Co., Dior, Givenchy, Séphora, and Moët & Chandon, among others.

LVMH Sells Majority Stake in Cruise Retail

LVMH’s cruise retail company is called Cruise Line Holdings Co. This parent company owns Starboard Cruise Services and Onboard Media businesses, offering handbags, jewellery, and beauty products on cruise ships. Notably, after the deal, LVMH’s products will also be offered on vacation retail locations on land. LVMH seldom mentions the Cruise Line Holdings’ business performance in its quarterly results. The pandemic-driven lockdowns have massively impacted the cruise line sector, and hence LVMH’s decision to offload its stake is no surprise.

The new investors hail from different areas of vacation retail space and are expected to bring about the much-required innovation and growth prospects for the new unit. LVMH said that Jim Gissy and associates will act as “strategic partners.” Gissy will be the chairman of the new company’s board, while Starboard’s current President & CEO, Lisa Bauer, will continue to lead the business.

What is the Future Price of LVMH Stock?

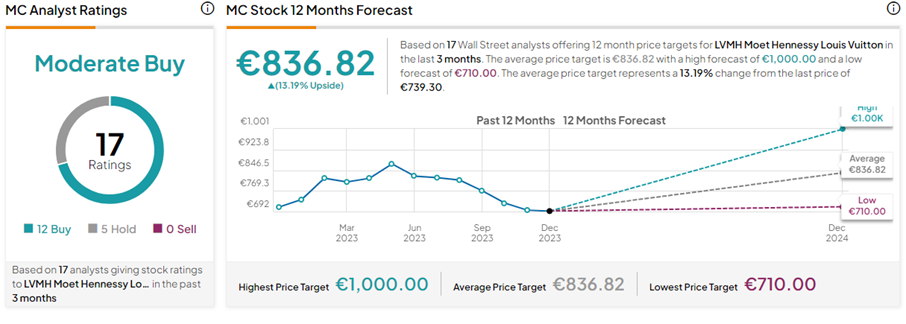

On Friday, Deutsche Bank analyst Francesca Di Pasquantonio cut the price target on MC stock to €790 (6.9% upside) from €805 while keeping a Hold rating.

Overall, the LVMH Moet Hennessy Louis Vuitton share price forecast of €836.82 implies 13.2% upside potential from current levels. On TipRanks, MC stock has a Moderate Buy consensus rating based on 12 Buys versus five Hold ratings. Year-to-date, MC shares have gained 8.2%.