In major news on Hong Kong stocks, shares of Li Ning Co. Limited (HK:2331) gained 5.67% as the company’s revenue climbed by 7% to ¥27.6 billion in 2023, compared to the previous year. Higher revenues were driven by the company’s footwear segment, which contributed around 48.5% of the total revenue. Li Ning shares are down by 63% in the last 12 months.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Li Ning is a leading Chinese sports brand, founded by former Olympic gymnast Li Ning. The company manufactures and sells apparel, footwear, and other sports equipment.

Insights from 2023 Results

In 2023, Li Ning’s net profit was down by 21.5% to ¥3.2 billion, mainly due to lower operating profits and impairment costs of ¥115.5 million. In 2023, the company’s inventory turnover was at its most efficient level over the last five years. The company also achieved a healthy inventory level, with 80% of its inventory consisting of products aged six months or less.

Speaking of shareholder returns, Li Ning announced a final dividend of ¥18.54 cents per share for 2023. This led to a total dividend of ¥54.74 cents per share in 2023, representing a total dividend payout ratio of 45%.

Looking ahead, Li Ning pledged to explore all options to boost shareholder returns. Additionally, it will prioritize capitalizing on its business in Mainland China, given its substantial size in this market and the uncertainty in global markets.

Analysts’ Reactions

Post-results, analyst John Chou from Jefferies reiterated a Buy rating on Li Ning stock, predicting a huge upside of 235%. Chou was impressed by the company’s inventory management and the higher online retail sales in the fourth quarter. He further stated that despite significant amortizations in the second half, earnings for the full year met expectations, bolstering confidence in the company’s financial well-being.

Likewise, Citi analyst Xiaopo Wei noted that the net profit declined but was in line with expectations. Last month, Wei confirmed a Buy rating on the stock.

Additionally, analysts at Goldman Sachs believe that the overall performance surpassed market fears, with inventory levels being the highlight. He thinks investors will closely monitor sales growth and margins this year. Goldman maintained its Hold rating on the stock.

What is the Target Price for Li Ning Stock?

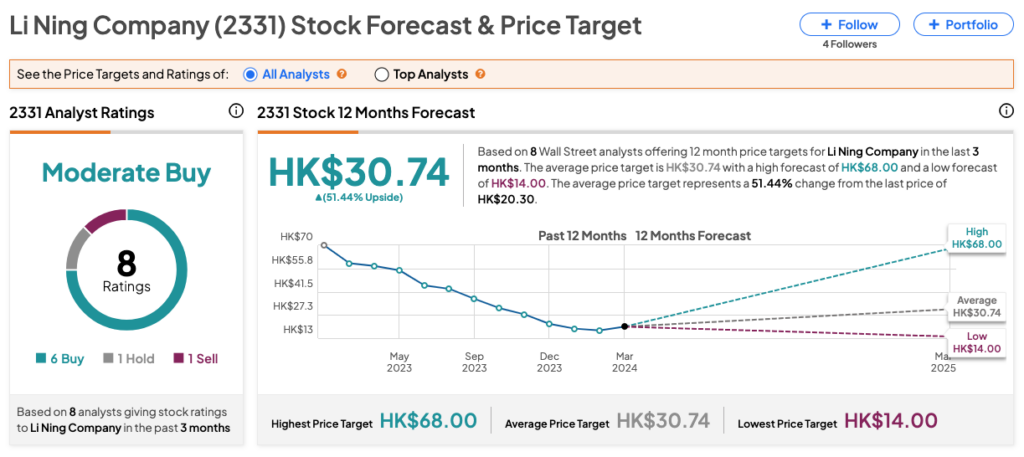

As per TipRanks, 2331 stock has received a Moderate Buy consensus rating, supported by six Buys, one Hold, and one Sell recommendation. The Li Ning share price forecast stands at HK$30.74, signifying a potential upside of 51.4%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue