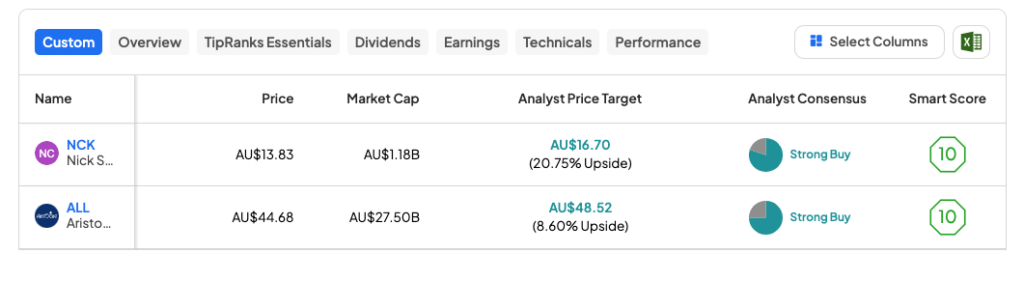

Using the TipRanks database, we have picked up two Australian stocks, retailer Nick Scali Limited (AU:NCK) and gaming technology company Aristocrat Leisure Limited (AU:ALL), that have scored a Strong Buy rating from analysts. Additionally, both these stocks have earned a “Perfect 10” on the TipRanks Smart Score tool, which indicates their potential to outperform the market.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The Smart Score tool assigns a score from one to ten, with stocks with scores of eight, nine, or ten having the potential to exceed market returns over the long term.

Let’s have a look at the details.

Nick Scali Limited

Nick Scali is a furniture retail company in Australia and New Zealand with a history of around 60 years. Year-to-date, NCK stock has risen by 12%.

The company recently ventured into the UK market with the acquisition of Anglia Home Furnishings Limited, trading as Fabb Furniture. As part of its growth strategy, the company intends to invest further in the existing Fabb Furniture network to introduce the Nick Scali brand in the UK. The acquisition presents a new avenue for growth for the company. As a result, the market and analysts have responded positively to Nick Scali’s plans to expand in the UK market.

Following the announcement of its UK acquisition, NCK stock has received four Buy ratings, including two rating upgrades. In particular, analyst Mark Wade from CLSA predicts the highest upside of 34% in the share price.

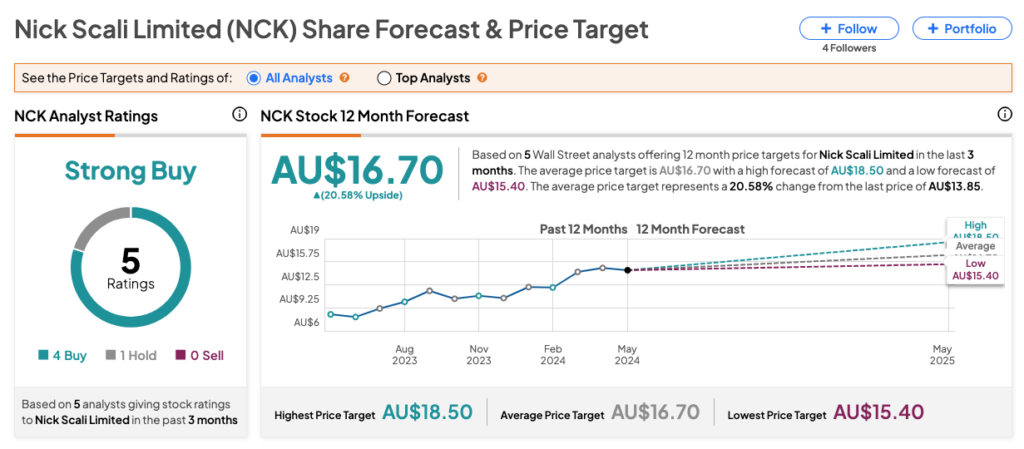

What is the Price Target for Nick Scali?

On TipRanks, NCK stock has a Strong Buy consensus rating based on four Buys and one Hold. The Nick Scali share price target is AU$16.70, which indicates 21% upside potential.

Aristocrat Leisure Limited

Aristocrat Leisure is a leading entertainment and gaming content company, offering products ranging from hardware systems to mobile games.

Earlier this month, the company released its first-half results for FY24, with revenue up by 6% and EBITDA increasing by 17.6% compared to the same period a year ago. The growth was mainly driven by Aristocrat Leisure’s North American gaming operations. For the full year, the company remains confident in its strong market share, along with its revenue and profit growth in its gaming business.

The company also announced a strategic review of its portfolio along with the results. As part of this review, the company will focus more on online real-money gaming and explore the possibility of selling two game developers that no longer align well with its portfolio.

Is Aristocrat Leisure a Good Buy?

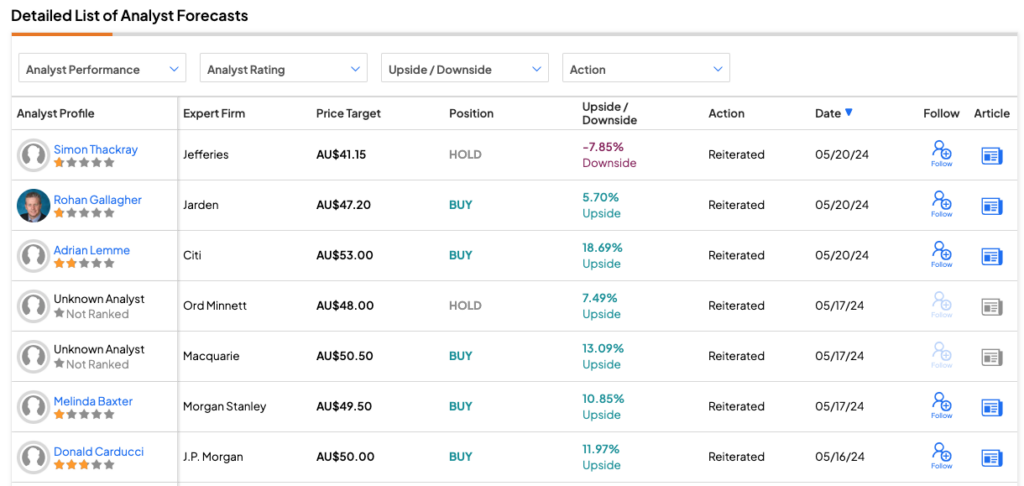

After its results, ALL stock received seven ratings from analysts, including five Buy recommendations.

Overall, ALL stock has a Strong Buy consensus rating based on six Buy and two Hold recommendations. The Aristocrat Leisure share price forecast of AU$48.52 implies 9.2% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue