FedEx (FDX), an American multinational delivery services provider, is set to release its first quarter of Fiscal 2025 financials on September 19. Wall Street analysts expect the company to post Q1 earnings of $4.84 per share, an increase of 6.4% year-over-year. Additionally, they expect FDX’s revenue to increase 1.1% from the previous year to $21.91 billion, according to TipRanks data.

Don’t Miss TipRanks’ Half Year Sale

- Take advantage of TipRanks Premium for 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

It’s important to highlight that the company has surpassed the consensus EPS estimates in seven out of the last nine quarters.

Factors to Consider Ahead of Q1

Analysts expect revenues and earnings to increase in Q1, signaling optimism for FDX’s near-term performance.

Also, according to TipRanks’ Bulls Say, Bears Say tool shown below, bulls believe that FedEx’s cost-reduction strategy highlights that successful network consolidation could lead to annual savings of $4-5 billion. Further, a standalone FedEx Freight division could bring in over $30 billion in enterprise value, representing a significant opportunity for shareholders. Bulls also noted that under its new leadership, FedEx is focusing on profitable growth, capital efficiency, and cost-saving initiatives across its operations.

Despite this optimism, it is important to consider the risks and concerns surrounding FedEx’s future performance. Bears pointed out that the termination of FedEx’s USPS contract is expected to significantly impact EBIT. Additionally, ongoing operational challenges and economic uncertainty continue to weigh on the parcel industry, keeping it out of favor.

Website Traffic Hints at FedEx’s Revenue Growth

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

Just as analysts expect a year-over-year increase in top-line numbers, TipRanks’ Website Traffic tool reinforces this outlook with supporting data.

According to the tool, total estimated visits to fedex.com grew by 15.4% year-over-year in Q1. This increase in visits suggests that demand for the company’s logistics services remained strong during the quarter.

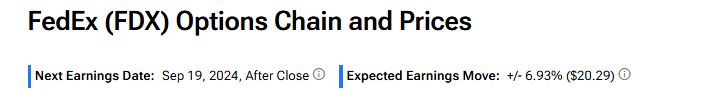

Options Traders Forecast 6.93% Stock Move Post-Earnings

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting a 6.93% swing in either direction.

Is FedEx a Good Stock to Buy?

Despite FedEx’s strong fundamentals, analysts remain divided on the stock’s future, as global shipments have remained sluggish this year.

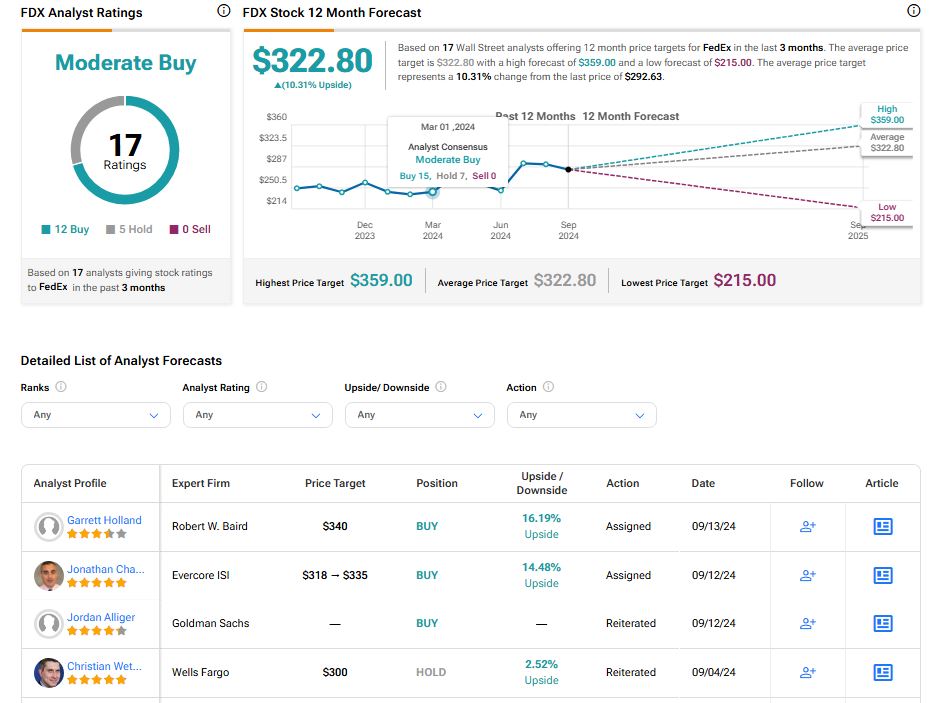

On TipRanks, FDX stock has a Moderate Buy consensus rating based on 12 Buys and five Hold recommendations. Also, the average FDX price target of $322.80 implies nearly 10% upside potential from current levels. Meanwhile, FDX shares have gained nearly 17% so far this year.