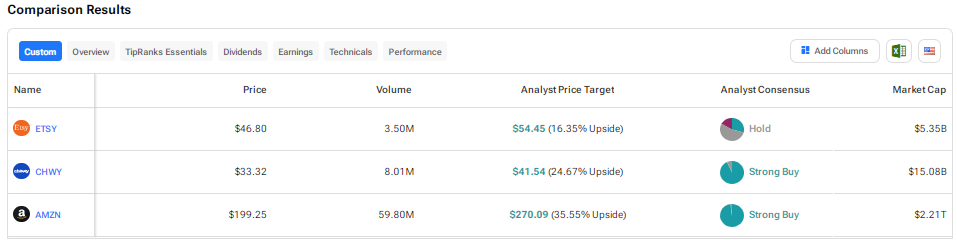

E-commerce is expected to grow at a strong rate due to continued digitalization, more online payment options, and enhanced shopping experience through the use of AI (artificial intelligence). Despite concerns about the impact of macro pressures on AI spending and tariff woes, analysts remain bullish on several e-commerce stocks. Using TipRanks’ Stock Comparison Tool, we placed Etsy (ETSY), Chewy (CHWY), and Amazon.com (AMZN) against each other to find the e-commerce stock with the highest upside potential, according to Wall Street analysts.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Etsy (NASDAQ:ETSY)

Etsy is an online marketplace for buyers and sellers of handmade and vintage goods. After enjoying a solid run during the pandemic, the company struggled due to growing competition and the impact of macro pressures on consumer spending.

The company recently reported disappointing revenue and gross merchandise sales (GMS) for the fourth quarter of 2024, blaming a competitive retail backdrop and pressure on consumer discretionary spending. Additionally, Etsy issued a dismal outlook for Q1 2025, saying that it expects a year-over-year decline in GMS that is largely in line with the decline reported for Q4 2024.

That said, Etsy’s CEO Josh Silverman stated that several factors could drive improvement in the company’s GMS beyond the first quarter. He added that the company is focused on increasing its buyer engagement, driving more sales, and returning to GMS growth.

Is ETSY a Good Stock to Buy?

In reaction to the Q4 2024 print, Cantor Fitzgerald analyst Deepak Mathivanan lowered the price target for Etsy stock to $43 from $46 and reiterated a Hold rating. The analyst noted that Etsy’s Q4 GMS was 3% below the Street’s consensus. However, EBITDA surpassed the Street’s expectation by 2% due to better take-rate and gross margin.

Although Q1 2025 guidance points to a near-term weakness, Mathivanan noted that the company expects revenue and profitability trends to improve in the second half of the year. Overall, Mathivanan prefers to remain on the sidelines due to uncertainties in ETSY’s fundamental outlook for 2025 and the pressure on GMS growth due to macro and company-specific challenges.

Wall Street is sidelined on ETSY stock, with a Hold consensus rating based on seven Buys, 13 Holds, and four Sells. The average ETSY stock price target of $54.45 implies about 16.4% upside potential. ETSY stock is down 11.5% so far this year.

Chewy (NYSE:CHWY)

Like Etsy, online pet foods and supplies retailer Chewy also faced intense pressure following the reopening of the economy after the COVID-19 pandemic. However, CHWY stock has rallied 90% over the past year, as investors cheered recovery in demand, improving financials, and the company’s efficiency measures.

Chewy delivered mixed results for the third quarter of Fiscal 2024 but raised its full-year revenue guidance. Also, its Q4 FY24 revenue growth estimate of around 13% growth reflected an acceleration from the third quarter top-line growth of 4.8%. The company’s revenue is improving due to its cross category product penetration, Autoship program, and customers’ interest in nondiscretionary categories, particularly within consumables and health.

Looking ahead, Chewy is scheduled to announce its Q4 2024 results on March 26. Analysts expect the company to report EPS (earnings per share) of $0.03 in Q4 2024 compared to $0.07 in the prior-year quarter. Revenue is expected to grow 13% to $3.20 billion.

Is Chewy Stock a Buy or Sell?

Chewy stock rallied on March 5 as the company’s CFO and analysts at Bank of America highlighted its limited exposure to China and, consequently, the newly imposed tariffs.

Following the CFO’s comments, Mizuho analyst David Bellinger reiterated a Buy rating on CHWY stock with a price target of $42. Bellinger recommended that investors should capitalize on any tariff-related dips in the stock. He estimates that a very minimal piece of Chewy’s business has exposure to tariffs. The analyst noted management’s comments that Chewy’s tariff exposure is in the “single digit millions” to “low teens millions” against its annual revenue base of more than $11 billion and EBITDA of over $500 million.

Meanwhile, Bellinger noted that there are indications of Chewy reaching an active customer “inflection point,” supporting his Top Pick status for the stock. He added that the latest high-frequency data suggests that net active customers are set to grow on a year-over-year basis for the first time in eight quarters, with CHWY heading into high ROI (return on investment) marketing spend.

With 14 Buys versus one Hold recommendation, Chewy stock scores a Strong Buy consensus rating on Tipranks. At $41.54, the average CHWY stock price target indicates 24.7% upside potential.

Amazon.com (NASDAQ:AMZN)

E-commerce giant Amazon’s better-than-expected fourth-quarter results were overshadowed by the Q1 2025 guidance miss. The company cited “unusually large, unfavorable impact” of forex headwinds for the subdued outlook.

Moreover, investors are concerned that despite substantial AI (artificial intelligence) tailwinds, the company’s cloud computing business AWS (Amazon Web Services) is growing at a slower growth rate than Microsoft’s (MSFT) Azure and Alphabet’s (GOOGL) Google Cloud.

Nevertheless, Amazon is confident about the road ahead and has boosted its capital expenditure from $83 billion to $100 billion to support demand for its AI services and build tech infrastructure to support its North America and International retail businesses.

What Is the Price Target for Amazon Stock?

Amazon recently launched Alexa+, its revamped digital assistant with generative AI features. Cheering this launch, Citi analyst Ronald Josey reaffirmed a Buy rating on Amazon stock with a price target of $273. Josey expects Amazon’s Alexa+ AI assistant to significantly accelerate the adoption of GenAI agentic applications.

Josey believes that Alexa+ makes Amazon a leader in AI, given that it is included as part of Prime and can be accessed by Alexa’s massive user base in the U.S. Specifically, Alexa’s user engagement increased 20% year-over-year in 2024 across more than 600 million Alexa-enabled devices sold life-to-date. Overall, Josey is bullish on Amazon’s AI prospects, and the stock remains a Top Pick for Citi.

Wall Street has a Strong Buy consensus rating on Amazon stock, backed by 46 Buys versus one Hold recommendation. The average AMZN stock price target of $270.09 implies 35.6% upside potential. AMZN stock is down 9% year-to-date.

Conclusion

Wall Street is highly bullish on Chewy and Amazon stocks and sidelined on Etsy stock. Currently, analysts see higher upside potential in AMZN stock than in the other two e-commerce stocks. Analysts are confident about the long-term growth potential of Amazon’s e-commerce business as well as the AWS cloud unit, especially amid the ongoing AI wave.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue