EToro is making another go at going public. The Israeli trading platform just filed for a Nasdaq IPO, aiming to raise up to $400 million after a record-breaking year in crypto. According to its prospectus, total commission was $931 million in 2024, up 46% year-over-year — with a staggering 96% of that coming from cryptocurrency trading. Not bad for a platform that once shelved its 2021 SPAC deal.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

EToro’s Growth Brings It to This Moment

Founded in 2007, EToro lets users trade everything from stocks and commodities to crypto—and even copy other traders’ moves. It’s now eyeing a $4.5 billion valuation, down from the $10.4 billion it targeted a few years ago.

Still, net income surged to $192 million in 2024, up from just $15.3 million in 2023, according to its Form F-1 filing. The IPO, under ticker “ETOR,” will be led by Goldman Sachs (GS), Jefferies (JEF), UBS (UBS), and Citigroup (C). Not bad company to keep when you’re trying to make a Wall Street splash.

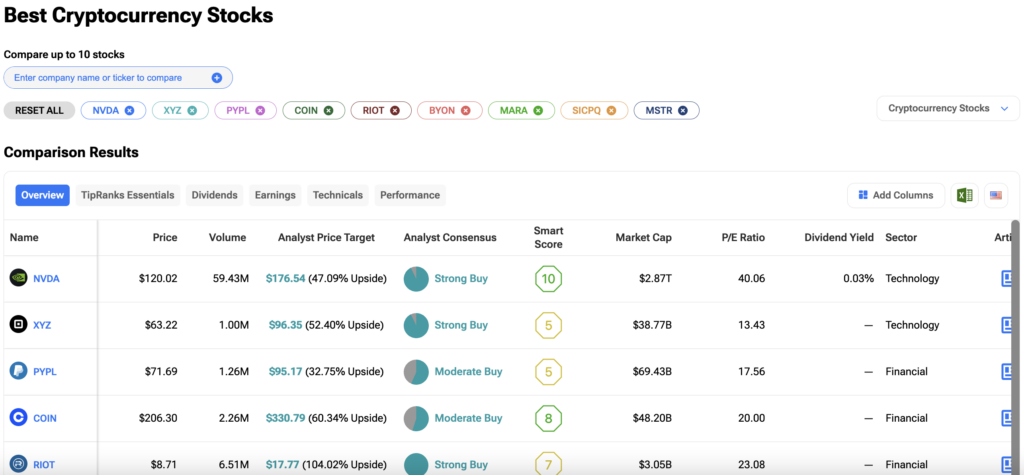

As crypto pushes further into the mainstream, companies with exposure to the sector could see their revenues climb. Of course, it depends on the business, but for investors, now’s a smart time to keep an eye on how their favourite crypto stocks are performing. Markets shift fast—and staying ahead means staying informed. You can compare top crypto-exposed stocks side-by-side using the TipRanks Crypto Stocks Comparison tool. Just click the image below to explore it.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue