Nike stock (NASDAQ:NKE) has plunged by about 59% from its 2021 highs, showing no signs of recovery. In fact, shares are trading at levels last seen during the 2020 crash. The bearish sentiment surrounding Nike is largely due to growing concerns over increased competition from emerging sportswear brands that are steadily capturing market share. With expectations of continued revenue and earnings declines, caution is needed despite the stock’s already significant drop. Accordingly, I am neutral on NKE stock.

Intensifying Competition Derails Nike’s Growth Narrative

Nike’s impressive growth trajectory over the decades has been marked by consistent revenue gains, even after it achieved peak maturity and established dominance in the sports apparel industry alongside giants like Adidas (DE:ADS). However, this narrative appears to fail to hold today, as smaller competitors are now actively capturing market share.

For context, NKE’s Fiscal Q4-2024 results marked a continued decline in revenue, extending a prolonged deceleration. Over the past seven quarters, Nike’s revenue growth figures have been as follows: 17.2%, 14.0%, 4.8%, 2.0%, 0.6%, 0.3%, and most recently, -1.7%. This consistent downturn in Nike’s top line is hard to deny.

Importantly, this decline cannot be attributed to cyclical factors; excluding FY2020’s results, which were affected by one-off, pandemic-related effects, Nike hasn’t posted such weak full-year revenue growth since the Great Financial Crisis in 2008-2010. In all other years during this period, growth rates typically ranged from mid-single digits to double digits.

Nike’s management attributed the recent revenue decrease to factors such as supply chain issues and an unfavorable macro environment. However, it doesn’t take a genius to see that growing competition appears to be the main catalyst here.

While it’s uncomfortable for Nike to acknowledge, the rise of smaller competitors aggressively seizing market share in sportswear speaks volumes. On Holding (NYSE:ONON), for example, the Swiss brand specializing in running shoes, has seen incredible traction. Its sales grew by 47% last year, following a 69% jump the year before. On is now also leveraging its brand to gain market share in the premium sportswear market.

Even Lululemon Athletica (NASDAQ:LULU), whose shares have plunged on slowdown concerns, saw a rather substantial increase of 19% last year. Meanwhile, smaller brands like Allbirds and Alo Yoga are also rapidly expanding in their respective niche categories, intensifying the competition further.

Nike’s Outlook Doesn’t Look Promising

The continuous worsening of Nike’s revenues would be more acceptable if it were merely a brief phase. Unfortunately, this does not seem to be the case. Nike’s management anticipates further challenges on the horizon, expecting a mid-single-digit decline in sales for FY2025. They attribute this forecast to product cycle transitions, slower growth in Nike Digital, and heightened macroeconomic uncertainties rather than competitive factors. In any case, however, the figures undoubtedly indicate quite a concerning trend.

Nike’s Valuation Remains Expensive Despite Recent Plunge

With Nike’s financials set to decline further in FY2025, the stock continues to seem quite expensive even after its already steep decline. Based on management’s comments and Nike’s overall sales trends across the globe, Wall Street expects that revenues decline by about 4.6% this year to $49.0 billion. In turn, the market expects that this revenue decline and margin pressures will lead EPS to fall by a more significant 19.2% to $3.19.

By employing these estimates, we see that Nike stock is trading at a forward P/E of 22.7x. This valuation appears quite lofty for a company potentially losing appeal to emerging, more vibrant competitors.

While Nike boasts significant strengths, such as having deep pockets and strong partnerships with athletes and teams, the data points to a possible trend where newer, more innovative, and creative brands slowly take market share. In this possible scenario, I wouldn’t be surprised to see Nike stock record further losses in the coming quarters.

Is NKE Stock a Buy, According to Analysts?

Wall Street seems a bit more optimistic about Nike’s future. The stock features a Moderate Buy consensus rating based on 13 Buys, 17 Holds, and two Sells assigned in the past three months. At $92.48, the average Nike stock price target suggests 26% upside potential.

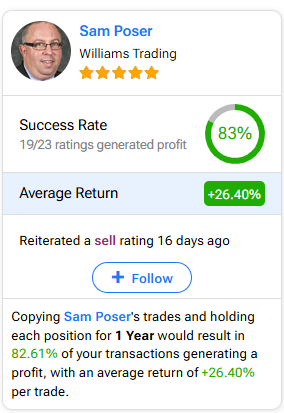

If you’re unsure which analyst you should follow if you want to buy and sell NKE stock, the most accurate analyst covering the stock (on a one-year timeframe) is Sam Poser from Williams Trading, with an average return of 26.41% per rating and an 83% success rate. Click on the image below to learn more.

The Takeaway

Nike’s stock has sustained a dramatic decline in recent years, possibly due to fierce competition from smaller, agile rivals. Despite its historic dominance, Nike faces a challenging road ahead with revenue declines that are expected to be sustained. Its struggles clearly underscore a broader shift in the sportswear market, where innovative newcomers are swiftly gaining ground.

Therefore, while Nike retains key strengths, these headwinds suggest caution for investors expecting a swift recovery in the near term. In fact, the stock’s valuation implies that further downside potential is not unlikely.