Advanced Micro Devices (AMD) stock has risen 21% year-to-date, fueled by a 33% jump in the past month. Optimism about the demand for AMD’s new AI (artificial intelligence) offerings has helped bolster investor sentiment and address concerns that the company is lagging behind Nvidia (NVDA) in the AI race. Several analysts have reaffirmed their Buy ratings on AMD following the Advancing AI event, while two analysts have upgraded the stock this week on renewed optimism. Many analysts believe that AMD stock has more room to run. However, Wall Street’s average price target indicates downside risk from current levels.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Analysts Are Upbeat on AMD’s Growth Prospects

Several analysts are now confident about Advanced Micro Devices closing the gap with rival Nvidia, driven by innovative products like the new MI400x chips and strategic acquisitions such as the ZT Systems deal. Moreover, prospects in sovereign AI have boosted investor sentiment.

At the recently held Advancing AI event, AMD provided new details about its next-generation AI chips, the Instinct MI400 series, which will compete with Nvidia’s GPUs (graphics processing units). Moreover, AMD’s MI350X and MI355X AI accelerators are expected to compete with Nvidia’s Blackwell products.

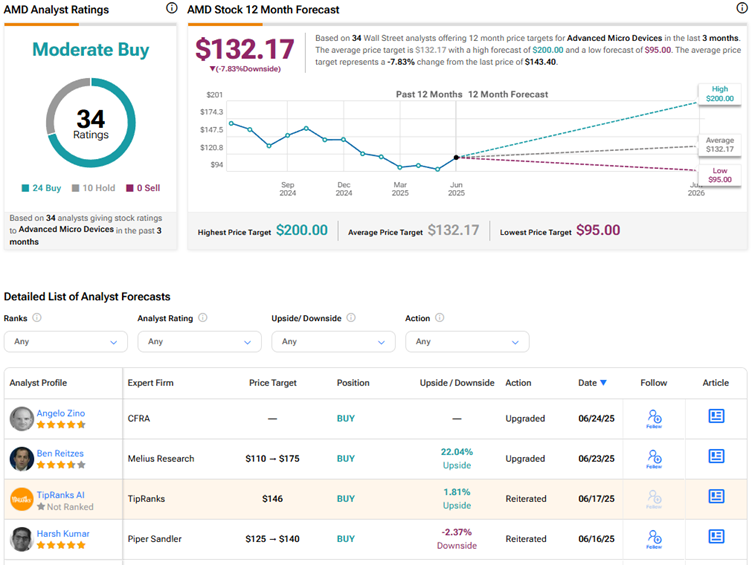

This week, Melius Research analyst Ben Reitzes upgraded Advanced Micro Devices stock to Buy from Hold and increased the price target to $175 from $110. The analyst noted several positives, including stronger-than-anticipated demand for AMD’s MI300 and MI350 series GPUs as well as early traction for the upcoming MI400 platform. Reitzes also highlighted demand for AMD’s products in AI inferencing and reducing risks in the PC segment. He also highlighted robust deal momentum, including those with Amazon (AMZN), OpenAI, Meta Platforms (META), and Saudi Arabia’s HUMAIN. Aside from GPUs, Reitzes expects continued share gains in high-margin server CPUs.

Meanwhile, Piper Sandler analyst Harsh Kumar increased the price target for AMD stock to $140 from $125 and reiterated a Buy rating. The 5-star analyst expects the company’s new products to aid GPU growth. Kumar is particularly enthusiastic about the Helios rack, which he thinks is key for AMD Instinct’s growth. He expects a “snapback” in AMD’s GPU business in Q425.

While Kumar’s price target indicates a 2.4% downside from current levels, Reitzes’ price target implies a 22% upside potential.

Is AMD a Buy or Sell?

Amidst macroeconomic challenges and concerns about chip export restrictions, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock, based on 24 Buys and 10 Holds. The average AMD stock price target of $132.17 indicates a possible downside of 7.8% from current levels.